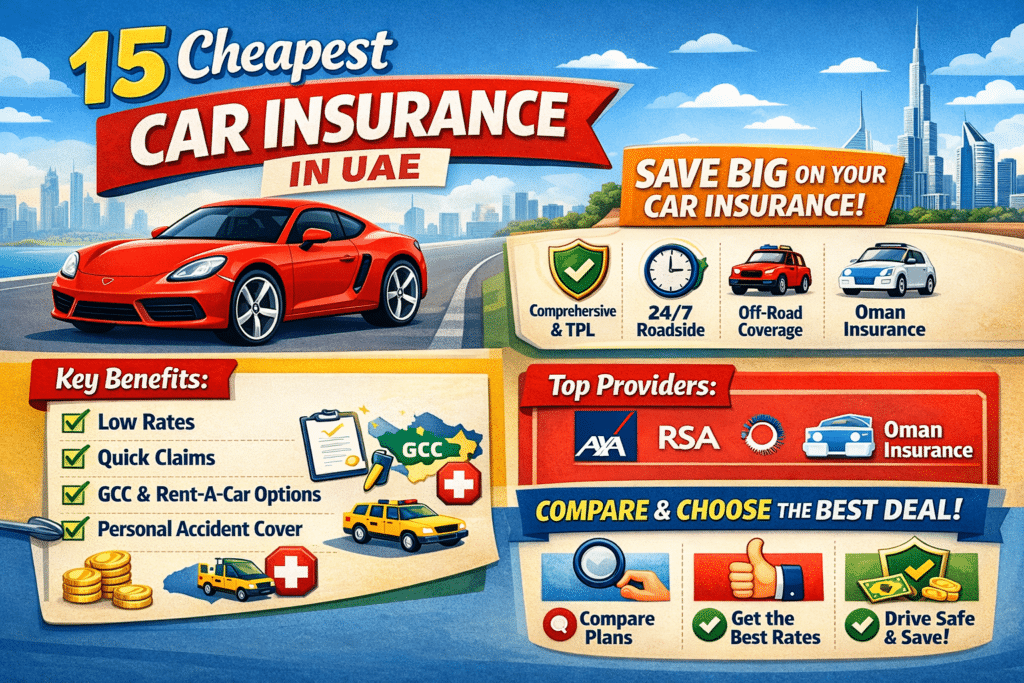

It may be difficult to know which among the many providers will provide the best value for money since most of them offer good rates. This guide discusses the 15 cheapest car insurance policies in the UAE with their features, advantages, and special services to enable you to make the right choice.

1. AXA Gulf

Overview

This company is known for offering a wide range of insurance products and services and providing high-level custom attention to clients. They offer various plan subscriptions depending on the users’ demands and ability to make a payment.

Key Features

- Full glass coverage and TPL both.

- 24/7 roadside assistance.

- Personal accident cover.

- Specialized 4 x 4 insurance.

Benefits

- Wide network of garages.

- Quick claims process.

- Optional add-ons like agency repair and rent-a-car services.

2. RSA Insurance

Overview

RSA Insurance is a leading provider with a strong reputation for reliability and customer satisfaction.

Key Features

- Personal accident benefits and medical Expenses on an extensive basis.

- Third-party liability cover.

- 24/7 emergency assistance.

- Coverage for natural calamities.

Benefits

- Efficient claims process.

- Very large and well-developed chain of approved garages.

- Extra covers such as GCC cover and off-road cover are also available.

3. Oman Insurance Company

Overview

Oman Insurance Company offers some car insurance products, including budget and standard; the two types of policies are flexible and cheap.

Key Features

- Comprehensive and third-party liability options.

- Personal accident cover for driver and passengers.

- Off-road coverage for 4×4 vehicles.

- 24/7 roadside assistance.

Benefits

- Fast and efficient claims settlement.

- Wide network of service centers.

- Optional add-ons like agency repair and rent-a-car services.

4. Abu Dhabi National Insurance Company (ADNIC)

Overview

ADNIC is a leading insurance company that is characterized by wide cover and fair prices.

Key Features

- Comprehensive and third-party liability coverage.

- Personal accident cover.

- 24/7 roadside assistance.

- Coverage for natural disasters.

Benefits

- Easy online policy management.

- Quick claims process.

- Additional services such as GCC cover and rent-a-car are optional.

5. Al Fujairah National Insurance Company (AFNIC)

Overview

AFNIC provides affordable, customer satisfaction-based, and reliable car insurance services.

Key Features

- Comprehensive and third-party liability options.

- Personal accident cover.

- 24/7 roadside assistance.

- Coverage for natural calamities.

Benefits

- Quick and efficient claims process.

- Wide network of garages.

- Optional covers like agency repair and off-road cover.

6. Noor Takaful

Overview

Noor Takaful offers various Sharia-compliant insurance services at competitive prices to help protect your assets.

Key Features

- Full and third-party liability

- Personal accident cover.

- 24/7 roadside assistance.

- Off-road coverage for 4×4 vehicles.

Benefits

- Efficient claims process.

- An extensive network of partner garages.

- Agency repair & rent-a-car services were added as part of the optional add-ons.

7. Emirates Insurance Company

Overview

Get best-in-class car insurance plans from Emirates Insurance Company, with different variants according to customers’ needs and pocket-friendly prices.

Key Features

- Comprehensive as well as Third-Party Only Covers

- Personal accident cover.

- 24/7 roadside assistance.

- Coverage for natural disasters.

Benefits

- Fast claims settlement.

- Extensive Network of Service Centers.

- Vehicle- GCC cover Add-on and Off-road add-on

8. Tokio Marine & Nichido Fire Insurance

Overview

Tokio Marine and Nichido fire insurance is reputed to be reliable in its service and also in the variety of cover.

Key Features

- Offers both broad and third-party liability options.

- Personal accident cover.

- 24/7 roadside assistance.

- Off-road coverage for 4×4 vehicles.

Benefits

- Quick claims process.

- Wide network of garages.

- Additional options include agency repair and rent-a-car possibilities.

9. Union Insurance

Overview

Union Insurance is a company that provides good customer service, competitive car insurance with high coverage.

Key Features

- Comprehensive and third-party liability options.

- Personal accident cover.

- 24/7 roadside assistance.

- Coverage for natural disasters.

Benefits

- Efficient claims settlement.

- Wide network of service centers.

- Optional covers like agency repair and off-road cover.

10. Dubai Insurance Company

Overview

The best but most affordable car insurance policies in the town are offered by the Dubai Insurance Company, with a strong focus on total coverage and client satisfaction.

Key Features

- Comprehensive and third-party liability options.

- Personal accident cover.

- 24/7 roadside assistance.

- Coverage for natural calamities.

Benefits

- Quick claims process.

- Wide network of garages.

- Available add-ons GCC cover and rent-a-car services.

11. Salama Islamic Arab Insurance Company

Overview

Salama Sharia-compliant car insurance with fair prices and flexible coverage plans.

Key Features

- Comprehensive and third-party liability options.

- Personal accident cover.

- 24/7 roadside assistance.

- Off-road coverage for 4×4 vehicles.

Benefits

- Efficient claims process.

- Extensive network of accredited repairers

- Optional covers like agency repair and rent-a-car services.

12. Takaful Emarat

Overview

Takaful Emarat offers low-cost Sharia-compliant Car Takaful solutions to cater to all types of customers’ needs.

Key Features

- Full & part-time liability options

- Personal accident cover.

- 24/7 roadside assistance.

- Coverage for natural calamities.

Benefits

- Fast claims settlement.

- Large Array of service centers

- GCC cover and off-road cover are optional add-ons

13. Watania Insurance

Overview

Watania Insurance offers wind Car insurance plans with competitive rates and extensive coverage

Key Features

- Comprehensive and third-party liability options.

- Personal accident cover.

- 24/7 roadside assistance.

- Off-road coverage for 4×4 vehicles.

Benefits

- Quick and efficient claims process.

- Wide network of garages.

- Optional covers related to agency repair and rent-a-car services.

14. National General Insurance (NGI)

Overview

NGI Affordable Car Insurance is that they emphasizes reliable service with good customer satisfaction.

Key Features

- Comprehensive and third-party liability options.

- Personal accident cover.

- 24/7 roadside assistance.

- Coverage for natural disasters.

Benefits

- Efficient claims process.

- Wide network of service centers.

- Add-ons like GCC covers and off-road covers.

15. Orient Insurance

Overview

Orient Insurance is a company that offers low-cost car insurance that comes with broad coverage and timely customer service.

Key Features

- Comprehensive and third-party liability options.

- Personal accident cover.

- 24/7 roadside assistance.

- Off-road coverage for 4×4 vehicles.

Benefits

- Quick claims process.

- Approved garages to network across the country.

- Agency repair and takeaway services are available, as well as rent-a-car services.

Read Also: How to Check ID Fines in Abu Dhabi: 2 Best Methods

Final Words

Picking the best car insurance coverage in the UAE not only improves your driving experience but also contributes to making you more secure financially. The providers we mentioned earlier provide the best and cheapest possibilities, but any of them are sure to improve your coverage at no extra cost. Tailor your car insurance to suit you, and compare the features and benefits of each provider relevant to your specific needs