Confused about how much tax you really need to pay in the UAE. You’re not alone. The question of how to calculate your tax in the UAE when faced with new corporate tax laws, continued VAT regulations, and updates being implemented in 2026, is still troubling even experienced entrepreneurs and freelancers, who are asking themselves the same question: How do I calculate my tax in the UAE?

We will also calculate all the types of taxes in the UAE in this guide, and step-by-step, how to calculate corporate tax, VAT, and freelancer tax. Calculate the tax in the UAE using our free UAE Tax Calculator to get instant, accurate results.

Tax System in the UAE

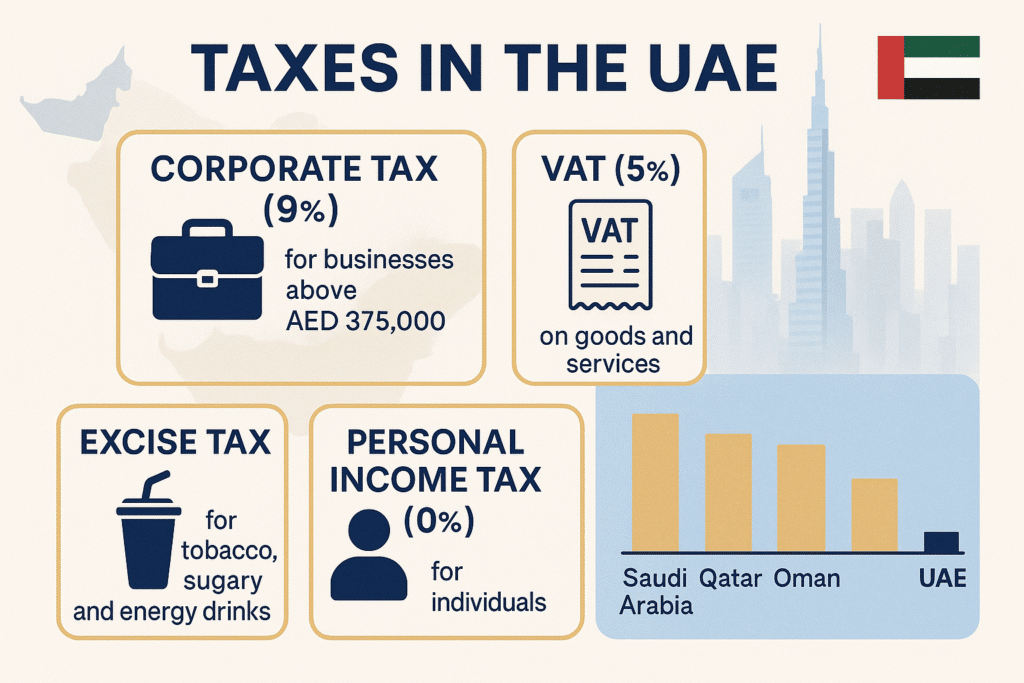

The taxation system in the UAE is business-friendly, although there are some taxes based on your activity:

| Tax Type | Rate | Who Pays |

|---|---|---|

| VAT (Value Added) | 5% | Consumers, businesses on goods & services |

| Corporate Tax | 9% (profits > AED 375,000) | Companies, some freezone businesses |

| Excise Tax | 50–100% | Sugary drinks, tobacco, and energy drinks |

| Customs Duty | 5% | Imported goods |

Who pays what:

- Individuals: Majorly, VAT on services and goods.

- Businesses: VAT, corporate tax, excise, and customs duties

- Freelancers / self-employed: VAT is provided if the turnover has already exceeded the necessary level.

Calculate Corporate Tax in the UAE

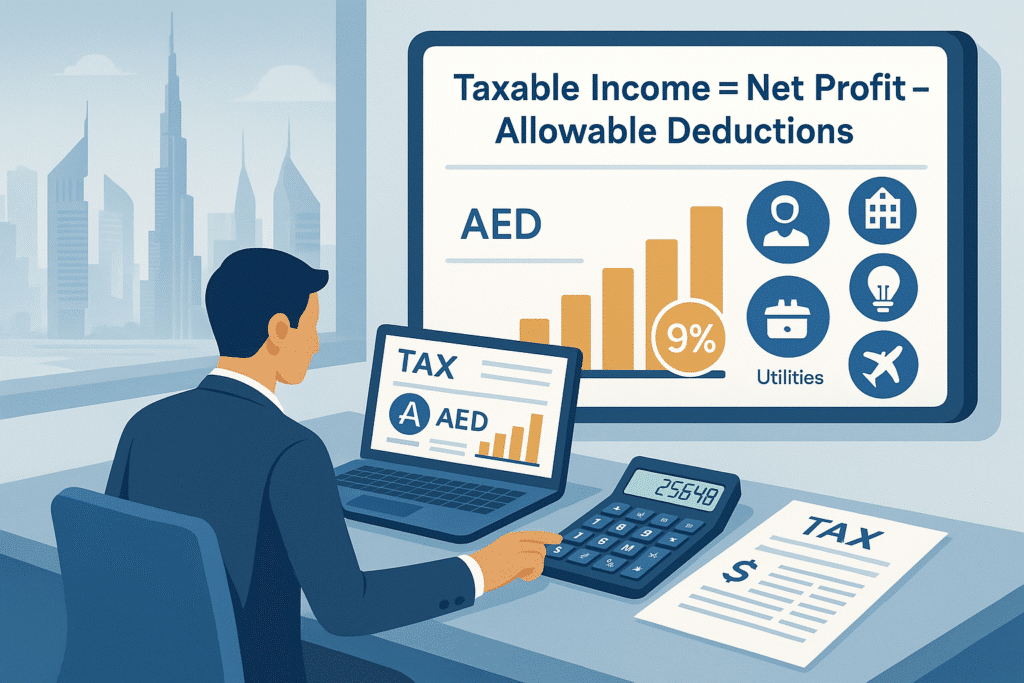

The corporate tax is imposed on companies and freelancers whose annual earnings exceed AED 375,000. It is not very complex to calculate; it is only a question of understanding what is taxable income.

Step-by-Step Process:

- Find Your Net Profit

Calculate your financial statements to determine your total revenue less operations. - Subtract Allowable Deductions

These include:- Salaries

- Rent & utilities

- Business-related travel expenses

- Depreciation of assets

- Calculate Taxable Income

Expenses on trips associated with business. - Apply Corporate Tax Rates:

- 0% for income up to AED 375,000

- 9% for income exceeding AED 375,000

Example:

With a taxable income of AED 600,000, a company will pay: 0% on the first AED 375,000 + 9% on the remaining AED 225,000 = AED 20,250

Online method

- Open the tool

- Go to UAE Tax Calculator.

- Choose your profile

- Select Company or Freelancer /Sole Proprietor, and choose the financial year.

- Enter your numbers

- Enter Net Profit (or add Revenue and Expenses in case your tool allows it). The tool will prepare the Taxable Income.

- Apply deductions & checks

- Include allowable expenses (salaries, rent, utilities, depreciation, etc.). The AED 375,000 threshold is automatically checked, and 0 percent below it, and 9 percent above it is applied.

- Calculate & review

- Hit Calculate to get:

Tax Calculation for Freelancers & Individuals

Freelancers who work within a trade license in the UAE are also liable to corporate tax in case their net profit surpasses AED 375,000.

Here’s a simple example:

Assuming that you make AED 500,000 per year, your taxable income = 500,000 -375,000= 125,000.

Apply 9% = AED 11,250 tax due.

In the case of earning less than AED 375,000, no tax is paid; however, registration is needed in the case of a licensed business.

Tips to Calculate Tax Accurately

- Keep all invoices and receipts

- Quick computation. Tax calculators are accurate and fast.

- Know which tax type applies to you

- Understand deductions, exemptions, and filing rules

Common Mistakes & How to Avoid Them

Taxes are erroneously handled by even seasoned business owners in the UAE. Here are a few to watch out for:

- Failing to file a corporate tax application in time.

- Failing to distinguish between the costs of business and personal costs.

- Confusion of VAT and corporate tax.

- Offering permissible deductions and that may reduce taxable income.

- Missing filing deadlines or using incomplete records.

Stay compliant: Accounting software should be used professionally, or a tax consultant should be engaged to guarantee this.

FAQs About Tax in the UAE

What is the VAT rate in the UAE?

Common 5 per cent on most products and services.

How much corporate tax do I pay?

9% on profits above AED 375,000.

Are there income taxes in the UAE?

No, people do not contribute personal income tax.

How do I calculate excise tax?

Multiply the product price by the excise rate (50–100%).

Do I have an opportunity to compute my taxes online?

Yes! Calculate our UAE Tax with our UAE Tax Calculator. UAE Tax Calculator

Read more: Check EVG Fine Online in UAE

Final Words

The tax computation in the UAE is not complex provided that you are familiar with rules and formulas. VAT, corporate tax, excise duties, everything you would require here is to remain up to date and save time.

Use our UAE Tax Calculator for accurate, instant calculations — perfect for businesses, freelancers, and individuals.