Yes! Foreigners can buy property in Dubai. Dubai has become an international trend of global real estate hotspot, and there are some ways for foreigners to own the property. Foreigners can acquire property in Dubai but it must take time to understand the various forms of tenures that are available, the legal aspect, and the experience before and after purchasing a property.

In this blog, I will explain can foreigners buy property in dubai can be a straightforward and profitable investment. This guide will walk you through everything you need to know, from ownership types to practical tips.

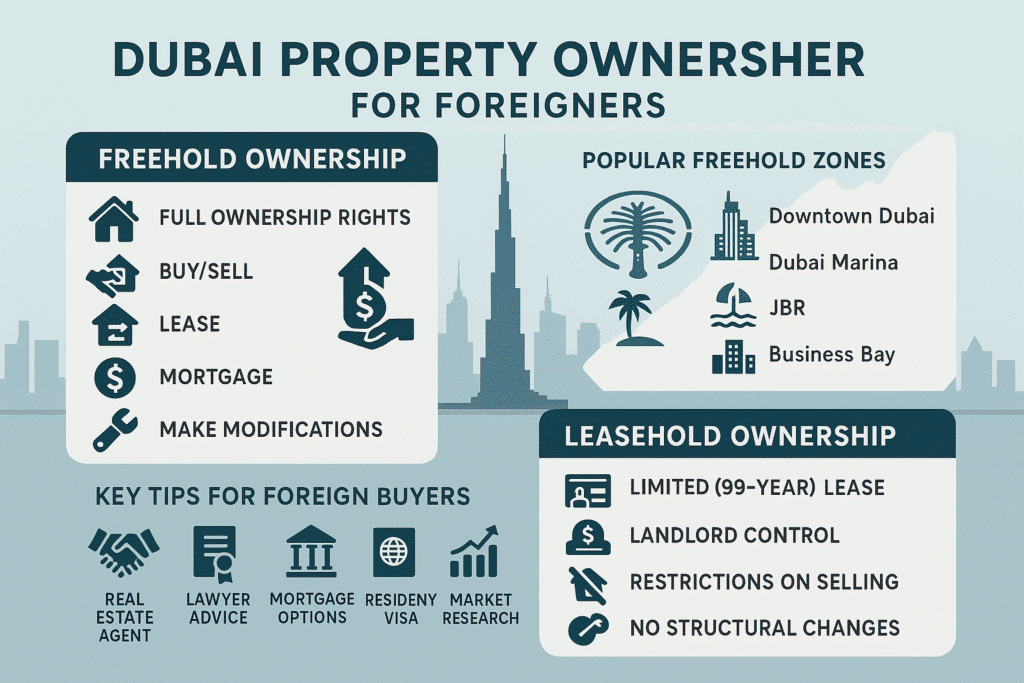

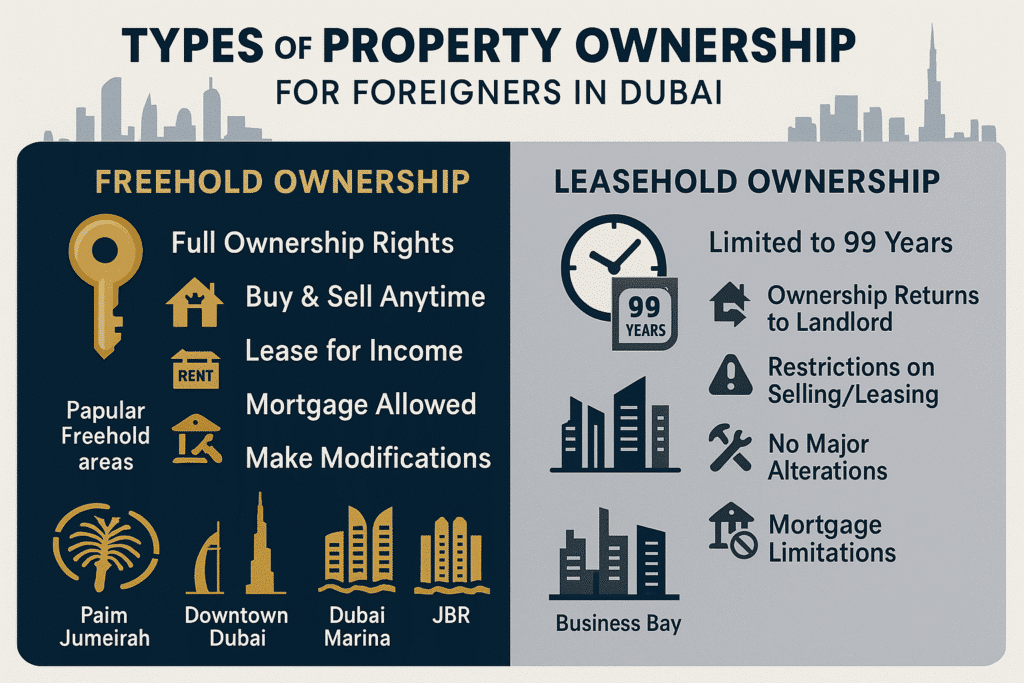

Types of Property Ownership for Foreigners in Dubai

Foreign property ownership in Dubai generally falls into two categories: Freehold Ownership and Leasehold Ownership. Each comes with its own set of rights, benefits, and limitations.

Freehold Ownership

The most popular choice of foreign buys in Dubai is freehold ownership. Because it grants complete property ownership rights and high degree of flexibility, it is a popular transaction instrument.

Designated Freehold Areas

The Dubai government has designated specific areas as “freehold” for foreign ownership. Foreigners can own the property here either on residential, commercial, or investment purposes. Some popular freehold zones include:

- Palm Jumeirah – Known for its iconic palm-tree shape, luxury resorts, and waterfront villas.

- Downtown Dubai – Downtown Dubai home to Burj Khalifa and Dubai Mall is perfect for urban folk.

- Dubai Marina – A vibrant community with skyscrapers, marina views, and entertainment spots.

- Jumeirah Beach Residence (JBR) – Beachfront properties offering high-end living with direct access to the beach.

- Business Bay – The financial hub of Dubai, ideal for those investing in commercial properties.

Full Ownership Rights

With freehold ownership, you enjoy full property rights, giving you the freedom to:

- Buy and Sell: There are no restrictions that forced the property to be bought or sold at any time.

- Lease: This can be doing the same with the property you’ve purchased to have a potential income stream.

- Mortgage: UAE banks or financial institutions can mortgage freehold properties.

- Make Modifications: You have control over modifications, so long as they adhere to local building regulations and community standards.

Freehold ownership is ideal for long-term investors or those looking for property ownership flexibility.

Leasehold Ownership

Even though leasehold ownership affords fewer rights than freehold, it’s still a viable option for those who want to buy into Dubai’s real estate market at a lower entry point.

Limited Ownership Period

In leasehold arrangements, you have the right to use the property for a fixed period, usually up to 99 years. Once the lease term expires, the property ownership returns to the landlord or property owner. Leasehold properties are commonly available in both residential and commercial sectors, often at more competitive prices than freehold properties.

Fewer Rights Compared to Freehold

Leasehold ownership in Dubai is generally more restrictive than freehold. Important points to note include:

- Restrictions on Selling or Leasing: There may be restrictions on selling, or subleasing, subject to landlord approvals.

- No Permanent Alterations: The property is not generally allowed to have major structural changes.

- Mortgage Limitations: Not all banks offer financing options for leasehold properties.

For those seeking to gain exposure to the Dubai real estate market, without the commitment of investing heavily in freehold ownership, leasehold ownership can be a real option of ownership.

Key Considerations for Foreign Buyers

Foreigners can easily invest in properties in Dubai though it is good to understand some of the procedures that followed when buying a property and some of the challenges that may be encountered. Some of the best areas that one needs to focus on are:

1. Work with a Qualified Real Estate Agent

However a professional agent who specializes in the Dubai real estate market can be quite helpful. A good agent will:

- Provide Market Insights: Dubai’s real estate market is dynamic. A really good agent who has been on the scene for a while can provide the client with information on the value of the property, the benefits of the location, and potential developments.

- Guide You Through Regulations: They can assist in this therefore on legal matters concerning the purchase agreements, residency and even laws of the state.

- Assist in Property Search: Agents can and should assist in the selection of properties that fit your budget, lifestyle, and more importantly investment plans.

- Negotiate Terms: A skilled agent can negotiate better purchase terms and clarify property specifics.

2. Seek Legal Advice

Legal consultancy should be sought at all times and particularly if the buyer is from another country. A Dubai-based real estate lawyer can help you understand:

- Contract Terms: Ensure you understand your purchase contract, especially for off-plan (under-construction) properties.

- Property Rights: They can explain some of the rights, which you might have or you do not have in leasehold estate.

- Legal Compliance: Such contingencies will be addressed by the lawyer to ensure that all relevant documents meet the standards of Dubai’s real estate as it contains less risk.

3. Explore Mortgage Options

Securing a mortgage in Dubai is possible for foreign buyers, but the terms and interest rates vary between banks. Here’s what you need to know:

- Eligibility Criteria: The remaining charges are said to range from 20-25% down payment for foreign nationals from banks here.

- Interest Rates: Interest rates may vary between 2-5% according to the banking institution and a number of factors of the buyer.

- Loan Tenure: Mortgages can go as long as 25 years but this largely depends on the buyer’s age or the ability to make contributions regularly.

- Loan Processing Time: When it comes to mortgage approval it usually can take anywhere from 2-3 weeks so timewise you have to factor this in if you require a mortgage to buy the car.

Exploring different banks and mortgage options can save you a substantial amount in interest payments.

4. Residency Visa and Its Benefits

It’s easier to access local banking services if one has a residency visa. Tax Advantages: The UAE is a tax haven; property owners stand advantageous due to the possibility of tax shield.

Advantages of a Dubai Residency Visa for Property Owners:

- Banking Ease: Access to local banking services can be simpler with a residency visa.

- Tax Advantages: The UAE is known for its tax-friendly environment; property owners can benefit from potential tax savings.

- Stay Flexibility: A residency visa provides one with an opportunity to live in Dubai for more days than where visit visas are required to be renewed.

Additional Tips for Buying Property in Dubai as a Foreigner

When investing in Dubai’s property market, thorough preparation is key. Here are some extra tips to consider:

1. Conduct Thorough Research

Before finalizing a property, research the area, development plans, and potential appreciation rates. It is important to follow recent sales within the neighboring area so as to rate the price standard and the trends.

Factors to Consider in Your Research:

- Amenities and Infrastructure: Proximity to schools, hospitals, shopping centers, and public transport.

- Future Developments: Several research was shown that planned projects such as metro stations, park, and commercial zone will be beneficial to your property.

- Community Standards: Different communities in Dubai have some rules for residents: about pets, parking, and maintenance, etc.

2. Perform Due Diligence on the Property

The next step is to carry out a background check on the property to ascertain if the property has any legal or financial liabilities. Due diligence can include:

- Title Deeds: Verify the property title deed to confirm ownership and legitimacy.

- Outstanding Liabilities: Check for any unpaid dues, such as service charges, on the property.

- Legal Status: Ensure the property is compliant with local building codes and community standards.

3. Budget Wisely

There are other charges in addition to the cost of the house that are usually associated with properties in Dubai. To avoid unexpected expenses, budget for the following:

- Registration Fees: Dubai Land Department levies 4% registration fee of the value of the property at the time of its purchase.

- Maintenance Fees: Neighbourhoods, and especially those consisting of high-rises or compound walls, impose a fee for use of amenities and compounds.

- Insurance Costs: Property insurance is not mandatory but is highly recommended to safeguard your investment.

4. Stay Updated on Dubai’s Real Estate Market

Dubai property market is characterized by fluctuation in some occasions. To become informed on market status, fiscal policies, and economic predictions it is crucial to continue researching. Regularly check:

- Property Appreciation Rates: It is wise to monitor the trends in your property’s market and especially the price fluctuations.

- Rental Yields: It is vital to understand the rental demand and amount of rental income to maximize in the area of interest.

- Policy Changes: Dubai’s laws of property purchases and its rules on visa status can alter from time to time, therefore the residents of the place must update themselves with the current laws.

Final Thoughts

Purchasing a property in Dubai is a good decision that can be very financially rewarding if well conducted. A legal perspective, with freehold zones, and high promising yields, Dubai stands as one of the most favorite destination among global property buyers. Understanding the types of ownership, the legal systems and regulations, and the market structure.