The Wage Protection System refers to an electronic system in the employment structure of the UAE that aims at protecting the wages of employees through timely and accurate payment of wages to the employees of the involved organizations.

In this blog, I’ll explain how you can check the WPS status of a company in the UAE, and know more about its legal compliance to UAE labor laws and employee well-being.

What is the WPS (Wage Protection System)?

The WPS is an electronic salary transfer system created by the UAE Central Bank in consultation with the MOHRE. It was introduced so that employees would be paid their wages as and when due under their contract of employment. Here’s what you should know:

- Purpose of WPS: Prevents changes to employees’ wages and unfair treatment, and allows companies to process their salaries with strict measures.

- Implementation: Applicable to all companies registered with MOHRE, it compels them to remit their employees’ wages using licensed banks and other financial institutions.

- Legal Compliance: Companies not compliant with WPS can face fines, operational restrictions, and legal action.

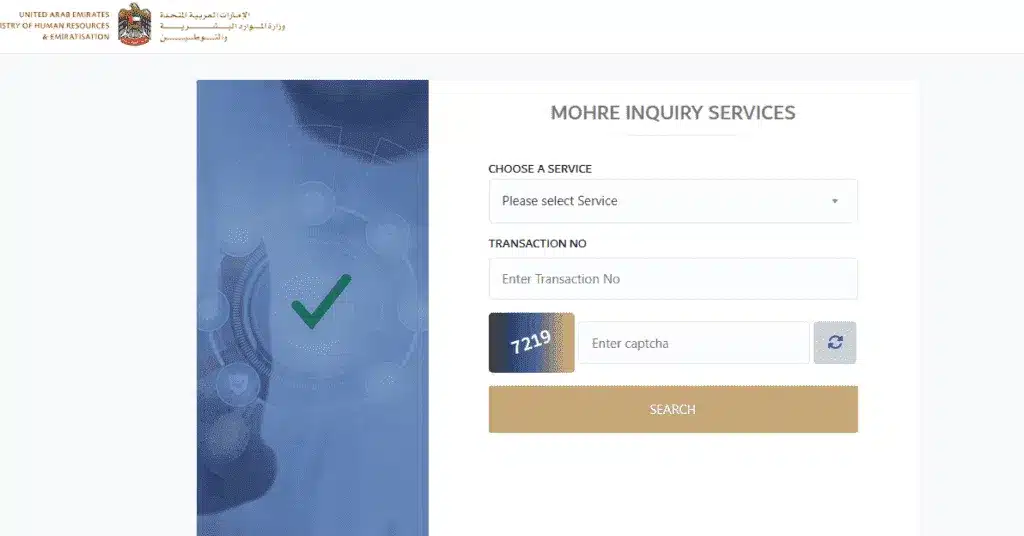

Method 1: Checking WPS Status Through the MOHRE Website

The Ministry of Human Resources and Emiratization (MOHRE) can help you check the status of a company’s WPS online. Below is a step-by-step process on how to use this particular method.

Step 1: Visit the MOHRE Website

- Open Your Web Browser: Start by launching a reliable web browser on your device.

- Go to MOHRE’s Official Website: Navigate to the official website of MOHRE (https://inquiry.mohre.gov.ae/).

Step 2: Select “Inquiry Services”

- Locate “Inquiry Services”: On this greatly designed homepage of MOHRE, scroll down to a menu labeled “Inquiry Services.” This section contains a number of links to check company information and labor contracts.

- Click on “Inquiry Services”: Selecting this will expand a list of options related to company inquiries.

Step 3: Choose “Company Information”

- Select “Company Information”: From the expanded list, look for an option labeled “Company Information.” This is where you’ll find details about the company’s status in the WPS.

- Click to Continue: Click on the “Company Information” link to proceed to the details section.

Step 4: Enter Company Details

- Provide Company Registration Number: You’ll be prompted to enter the company’s registration number. Ensure accuracy, as incorrect details can lead to invalid results.

- Input Other Details (If Required): Some cases may require additional information, such as the company name or type.

Step 5: Submit the Request

- Click “Submit”: After entering the required details, click the “Submit” button to initiate the inquiry.

- Wait for the System to Process: The system will retrieve the relevant company data from its database.

Step 6: View the Results

- Check for WPS Compliance Information: When the result shows, you will be able to see the WPS registration and other information on the company’s compliance.

- Save or Print (If Necessary): You may want to save a screenshot or print the information for future reference.

Method 2: Checking WPS Status Through Your Bank

Your bank can also confirm the WPS status of a company if you are an employee of the said company or if you frequently transact with them. This option will especially come in handy in the instance that you do not have access to the MOHRE website or you prefer a one-on-one service.

Step 1: Contact Your Bank

- Call Customer Service or Visit a Branch: The first step is to call the customer service of your bank or go directly to the bank and talk to an officer.

- Request to Speak to a Representative: Make sure you get to speak with bank personnel dealing with corporate or payroll issues.

Step 2: Provide Company Details

- Share Company Name or Registration Number: In this step, the shareholder needs to provide the name of the company and the registration number so that the verification can be done.

- Verify Your Identity: You could be required to provide your personal identity details in order to be verified in case you are checking in on behalf of a company or because you are an employee.

Step 3: Verify WPS Status

- Request WPS Compliance Information: Make the bank representative verify that the company complies with WPS regulations.

- Receive Confirmation: The bank will verify its internal systems and can give confirmation on the status of the company on the WPS compliance.

Benefits of Using WPS in the UAE

For Employees

- Timely Salary Payments: WPS ensures that employees receive salaries in time, which leads to financial security.

- Transparency: Workers will have transparent records of the payment of salaries, which will minimize any disagreements about wages.

For Employers

- Legal Compliance: Adherence to WPS regulations will ensure that companies remain in line with the UAE laws and do not face fines and penalties.

- Enhanced Reputation: WPS compliance has a positive impact on the reputation of a company, which will attract talents and partners.

For the Government

- Improved Wage Regulations: WPS assists the government in controlling the pay and avoiding problems such as salary conflicts.

- Better Data Collection: It gives MOHRE data to interpret wage trends and seek possible ways of improvement.

Read Also: UAE Driving License Types: A Complete Guide to Navigating the Roads

Final Words

In this guide, I have discussed two of the sure ways of ensuring the status of WPS of a company in the UAE, by employing the MOHRE site and by checking with a bank. Be it as an employee, a job seeker or a business partner, being informed on how to check WPS status gives you the ability to make more informed decisions on employment and partnerships. Never forget that WPS is an important aspect of the struggle by the UAE to uphold the rights of employees and ensure fair working conditions.

This way, you can easily check the compliance status of any company in terms of their WPS and be assured in your transaction with them.