Emirates NBD is one of the leading banks in the UAE, offering a wide range of financial products and services, including credit cards. Upon receiving your Emirates NBD credit card, whether it’s a Visa or Mastercard, you’ll need to activate it to initiate its functionality.

What is Emirates NBD Credit Card?

Emirates NBD credit cards are versatile financial tools that offer cardholders various benefits such as rewards, cashback, discounts, and exclusive privileges. These cards come with different features tailored to meet the diverse needs of customers, including travel benefits, dining offers, and lifestyle perks.

How to Make Emirates NBD Credit Card Payments

Emirates NBD offers a range of credit cards that provide convenience and flexibility to its customers. With various payment options available, settling your credit card bills has never been easier. In this guide, we will walk you through the different methods you can use to make Emirates NBD credit card payments.

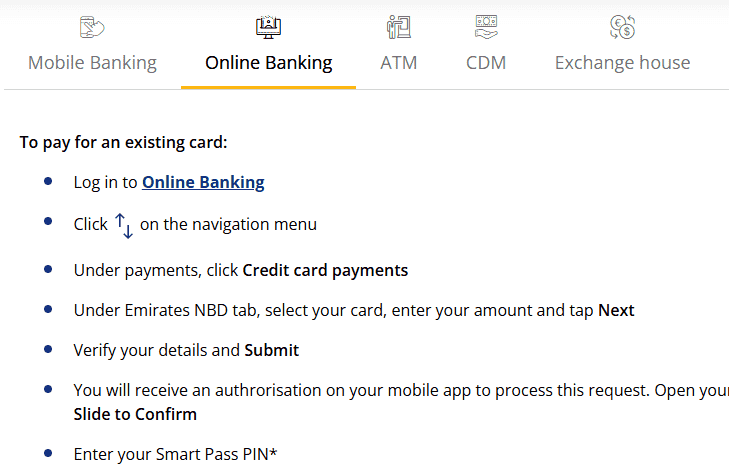

1. Online Payments

Emirates NBD provides a user-friendly online banking platform that allows you to manage your credit card payments efficiently. Here’s how you can make your credit card payment online:

- Login to your Emirates NBD online banking account.

- Select the “Payments” option from the menu.

- Choose “Credit Card Payments” from the available options.

- Select the credit card you wish to make a payment for.

- Enter the payment amount and confirm the transaction.

Once the payment is processed, you will receive a confirmation message, and your credit card balance will be updated accordingly.

2. Mobile Banking App

If you prefer managing your finances on the go, Emirates NBD’s mobile banking app is the perfect solution. Follow these steps to make your credit card payment using the app:

- Download and install the Emirates NBD mobile banking app from your app store.

- Log in to your account using your credentials.

- Navigate to the “Payments” section within the app.

- Select “Credit Card Payments” from the available options.

- Choose the credit card you want to pay and enter the payment amount.

- Confirm the transaction to complete the payment.

With the mobile banking app, you can conveniently make credit card payments anytime, anywhere, ensuring that your payments are never delayed.

3. AutoPay

To avoid the hassle of remembering payment due dates, Emirates NBD offers an AutoPay facility. By enrolling in AutoPay, your credit card payments will be automatically deducted from your chosen bank account on the due date. Here’s how you can set up AutoPay:

- Login to your Emirates NBD online banking account.

- Go to the “Services” section.

- Select “AutoPay” from the available options.

- Follow the instructions to set up AutoPay for your credit card.

Once you have successfully enrolled in AutoPay, your credit card payments will be made automatically, giving you peace of mind and ensuring that you never miss a payment.

4. Cash Payments

If you prefer making payments in person, you can visit any Emirates NBD branch and settle your credit card bill in cash. Follow these steps to make a cash payment:

- Locate the nearest Emirates NBD branch.

- Visit the branch and proceed to the customer service desk.

- Inform the representative that you would like to make a credit card payment.

- Provide your credit card details and the payment amount.

- Pay the amount in cash and collect the receipt for your records.

It is important to note that cash payments may take some time to reflect in your credit card account. Therefore, it is advisable to make your payment well in advance of the due date to avoid any late payment charges.

5. Cheque Payments

If you prefer using cheques for your credit card payments, Emirates NBD allows you to make payments through this method as well. Here’s what you need to do:

- Write a cheque payable to “Emirates NBD Bank.”

- Write your credit card number and the payment amount on the cheque.

- Drop the cheque in any Emirates NBD cheque deposit box or ATM.

Ensure that you make the cheque payment well in advance of the due date to allow for processing time. It is also recommended to keep a record of the cheque for future reference.

Read More: Cheap Hotel In Bur Dubai 100 AED.

Step-by-Step Guide to Activate Emirates NBD Credit Card

Let’s delve into the detailed activation process for each method:

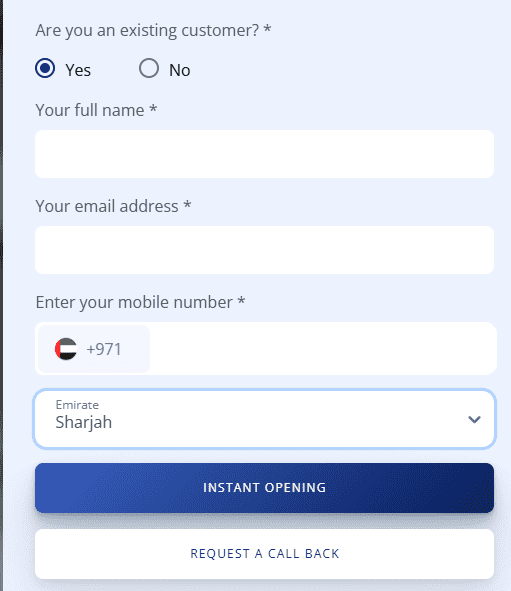

Online Activation Process

- Visit the Emirates NBD official website.

- Navigate to the credit card activation page.

- Enter your card details, including the card number, expiry date, and CVV.

- Follow the on-screen instructions to verify your identity and complete the activation process.

Mobile App Activation Process

- Download and install the Emirates NBD mobile banking app.

- Log in to your account using your credentials.

- Navigate to the credit card section within the app.

- Select the option to activate your new card and follow the prompts to complete the process.

Phone Call Activation Process

- Dial the Emirates NBD customer service helpline.

- Choose the option to speak to a representative.

- Provide your card details and personal information as requested.

- Follow the instructions provided by the representative to activate your credit card.

ATM Activation Process

- Locate an Emirates NBD ATM nearest to you.

- Insert your credit card into the ATM machine.

- Select the option for card activation from the menu.

- Follow the on-screen prompts to validate your identity and activate your card.

Troubleshooting Activation Issues

Despite the simplicity of the activation process, you may encounter some common issues:

Common Problems and Solutions

- Incorrect Card Details: Ensure that you enter the correct card number, expiry date, and CVV during the activation process.

- Technical Glitches: If you experience any technical difficulties on the website or mobile app, try clearing your browser cache or restarting your device.

- Expired Activation Link: If activating online, ensure that you use the activation link within the specified timeframe to avoid expiration.

Tips for Successful Activation

To ensure a smooth activation process, consider the following tips:

- Double-check your card details before initiating the activation process.

- Choose a secure and reliable internet connection when activating online or through the mobile app.

- Keep your card and personal information confidential to prevent unauthorized access.

Benefits of Timely Credit Card Payments

Avoiding Late Fees and Penalties

Timely credit card payments help customers avoid unnecessary fees and penalties imposed for missed or late payments. By settling their bills promptly, users can maintain a positive financial standing and avoid adverse effects on their credit score.

Improving Credit Score

Consistently paying credit card bills on time contributes to building a positive credit history, which is essential for securing loans and other financial products in the future. A high credit score reflects responsible financial behavior and enhances the borrower’s credibility.

Read More: Funny Things to do in Dubai.

Security Measures for Online Credit Card Payments

Two-Factor Authentication

Emirates NBD employs robust security measures to protect online transactions, including two-factor authentication methods such as SMS verification codes and biometric authentication.

Secure Payment Gateways

The bank’s online payment portal utilizes encrypted connections and secure payment gateways to safeguard sensitive financial information. This ensures that customers can make transactions with confidence, knowing that their data is protected from unauthorized access.

Customer Support for Credit Card Payment Assistance

Helpline Numbers

Emirates NBD provides dedicated customer support channels, including helpline numbers staffed by trained professionals who can assist customers with credit card payment queries and troubleshooting.

Online Chat Support

For immediate assistance, customers can also utilize the bank’s online chat support feature available through the website and mobile app. This real-time support option allows users to resolve issues efficiently without the need for phone calls or branch visits.

Conclusion

Activating your Emirates NBD credit card is a straightforward process that can be completed through various convenient methods, including online, mobile app, phone call, or ATM. By following the step-by-step instructions provided in this guide, you can activate your card securely and start enjoying its benefits.