The Payment Prepaid Card (PPC) provided by First Abu Dhabi Bank (FAB) can be regarded as one of the most successful financial solutions within the UAE. The PPC card, targeted more towards businesses, makes the management of cash, repetitive payments, and general financial management easy.

In this blog, I will walk you through everything you need to know about the PPC FAB card to make it a useful tool for your business/personal needs.

What is the PPC FAB Card?

The PPC Bank FAB card is a prepaid card provided by First Abu Dhabi Bank (FAB) in the UAE. The PPC FAB card offers users a smooth and unified procedure for managing petty cash and recurring business expenses, along with controlling secure business payments.

- No Bank Account Required – Use independently

- Secure Transactions – Chip & PIN, OTP for online purchases

- Widely Accepted – Use at ATMs, POS machines, and online

How to Check PPC FAB Card Balance Online

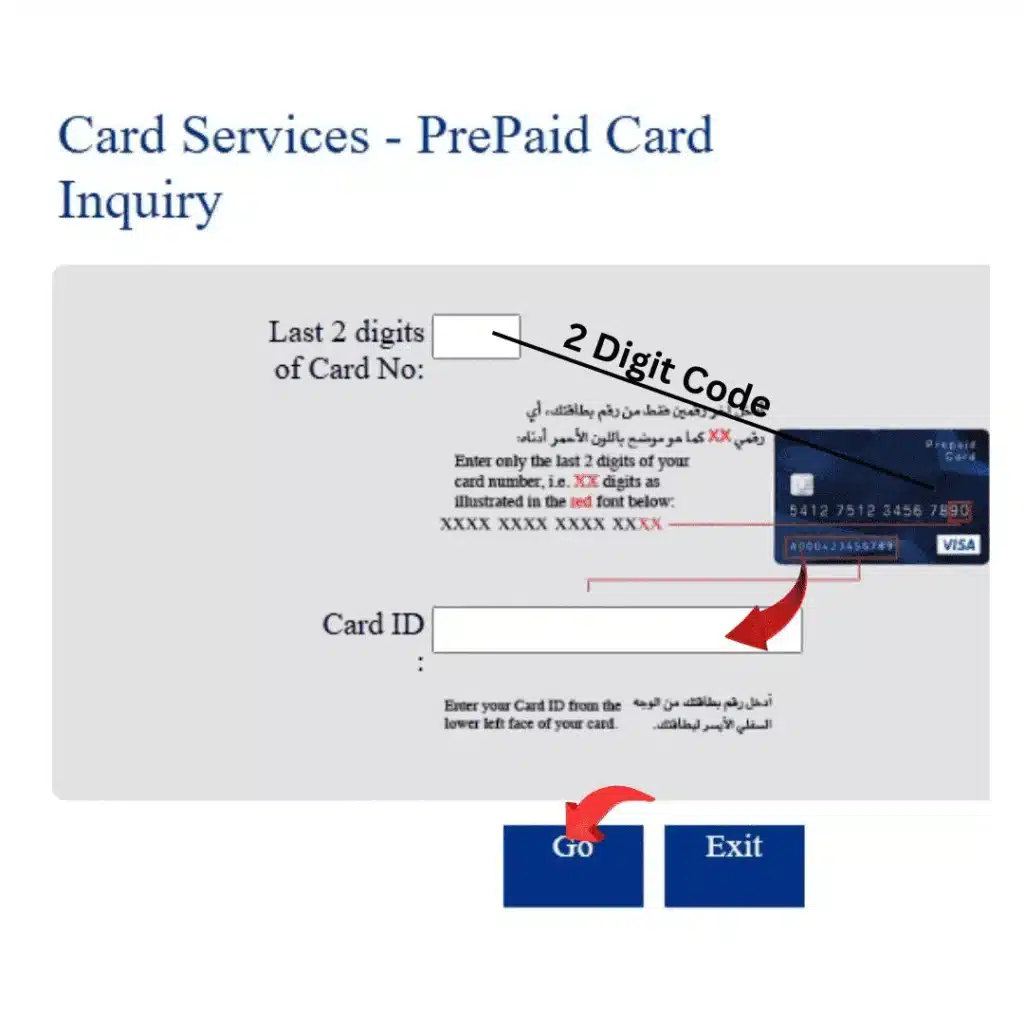

If you’re searching for “PPC balance enquiry”, follow these steps:

Step 1: Access the FAB Online Banking Portal

- Visit the Official Website: Go to the FAB online banking portal.

- Login: Use your registered username and password to access your account.

Step 2: Locate Prepaid Card Balance Information

- Account Summary: Look for an overview section displaying all accounts, including prepaid cards.

- Card Management Section: If not immediately visible, navigate to the section specifically for prepaid cards.

Step 3: View Your Balance

- Check the Display: Your prepaid card balance will be prominently shown on the screen.

Important Notes

- Online Banking Registration: Ensure you are registered for online banking services to access this feature.

- Security Measures: Use strong passwords, avoid sharing credentials, and always log out after use.

- Customer Support: You can contact FAB customer service for any assistance or unresolved issues related to ppc card inquiry.

How to Get a FAB PPC Card

Step 1: Contact FAB

- Visit a Branch: Walk into any FAB branch to inquire about the card.

- Online Inquiry: Use the official FAB website to explore options and start the application process.

Step 2: Provide Required Documentation

- Business License: Ensure your company’s registration is valid.

- Identification: Provide copies of valid Emirates IDs and passports of authorized personnel.

- Supporting Documents: Submit any additional paperwork requested by FAB.

Step 3: Load and Use the Card

- Once issued, load funds onto the card as needed and start using it immediately.

Key Features of the PPC FAB Card

Prepaid Card Functionality

- The PPC FAB card operates on a prepaid basis, allowing you to load it with funds in advance.

- Suitable for budgeting as it limits spending to the amount loaded.

Usage

- Ideal for handling petty cash and managing recurring payments.

- Usable across the UAE at ATMs, POS terminals, and online platforms.

Flexibility

- Offers multiple use cases, including:

- Withdrawing Cash: Easily withdraw cash from ATMs across the UAE.

- Making Purchases: Pay securely at POS terminals for goods and services.

- Online Transactions: PPC FAB card will seamlessly make online purchases with OTP verification.

Convenience

- No Activation Required: The card is ready to use upon issuance.

- No Bank Account Needed: Use it independently without linking it to a bank account.

- No Monthly Fees: Enjoy financial freedom without a minimum balance or monthly charges.

Enhanced Security

- Chip and PIN Technology: Protects against fraud and unauthorized use.

- One-Time Password (OTP): Adds an extra security to online purchases.

Management Tools

- Corporate Payment Solutions: Authorize spending and limit the expenditures of your employees.

- Online Management Module: Check balances, monitor the transactions, and manage various cards easily.

Benefits for Businesses

Improved Cash Flow Management

- Eliminates the use of physical money, and financial operations become more efficient.

Enhanced Security

- Eliminates cash theft, loss, or misappropriation risks.

Increased Efficiency

- Eases and automates the process of payment, which saves time and effort.

Better Expense Control

- Offers centralized transaction monitoring and restricts unnecessary expenditure.

Employee Convenience

- Provides a safe and convenient payment system to employees.

Read Also: Open FAB iSave Account Easily: Step-by-Step Guide

Why Choose the PPC FAB Bank Card?

The PPC FAB card is not a mere financial tool; it is a business holistic tool that enhances the financial operations of any business. Here’s why it stands out:

Simplified Financial Processes

- Eliminates the need for manual petty cash management.

- Automates recurring payments with ease.

Financial Transparency

- Offers in-depth information about the expenditure, which allows for making a better decision.

Adaptability

- PPC FAB card fits various financial requirements, whether it is a small business or a big company.

Support from FAB

- It has the strength of First Abu Dhabi Bank, having vast resources and experience that make it reliable and trusted.

Read Also: Crack the FAB Car Loan Code: Your Ultimate Guide

Final Words

The PPC FAB card is a necessary element for the company that conducts business in the UAE. Its prepaid feature, high security levels, and flexible applications make it easy to handle finances and improve the efficiency of operations. You should use the PPC FAB card when you want to simplify the work with petty cash, and also ensure that your employees are given safe ways to pay. Knowing its features and advantages, you will be able to use it to address your particular financial needs in the best way possible.

Visit your nearest FAB branch or apply online to start using your PPC FAB card immediately.