Living in the U.A.E. is an experience full of interesting events, and at times, special demands may appear. A personal loan from FAB is the ideal solution you need to fulfill your ambitions without wreaking havoc on your financial plan. Therefore, this comprehensive guide equips you with just what you need to move through the How To Get FAB Personal Loan application journey, to achieve a smooth and successful experience.

FAB Personal Loans

FAB Personal Loan is an unsecured loan category offered by the First Abu Dhabi Bank (FAB), a top-tier financial institution established in the United Arab Emirates. This kind of loan allows customers to borrow a fixed sum of money without providing any collateral.

Steps To Get a FAB Personal Loan

1. Check the FAB website

Go to ( https://www.bankfab.com/en-ae/personal/loans/personal-loans ).

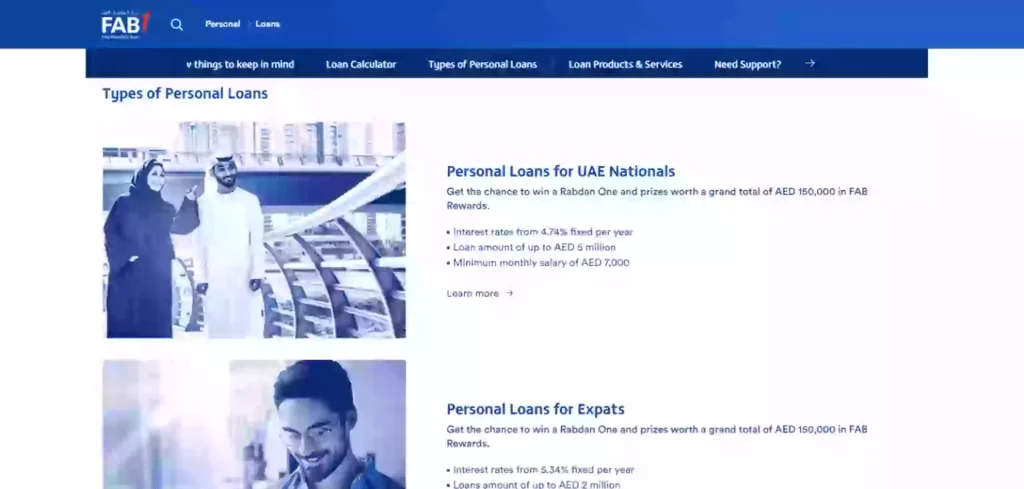

2. Choose the Loan Type

On the FAB Personal Loan webpage, start by identifying a loan variant that meets your needs. UAE residents, be it Emirati citizens or expatriates, together with FAB have a personalized loan product choice to fit your needs.

3. Enjoy the Loan Calculator

In addition to its other features, we also have a loan calculator tool on the website for those who are looking for the basis of their monthly payments and the actual total loan cost.

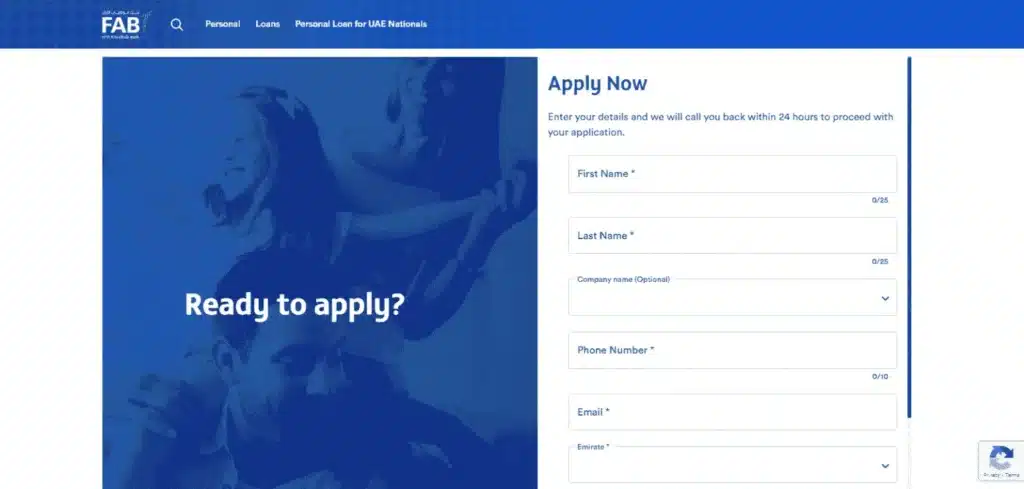

4. Starts with Online Application

Following the choice of the loan type, you have to hit the ground running by commencing the application process. Move the mouse towards the bottom right side of the screen to locate the “APPLY NOW” button and then click on it to go forward.

5. Complete the Application form

The online application process is going to request details related to your personal information, such as employment status, income, and the amount of the loan you would like.

6. Upload Required Documents

The verification process can be eased by the provision of a specific set of documents according to the FAB rules. They normally comprise of the identification proof, income statements, and evidence reliant on the case under consideration.

7. Submit Your Application

After you apply, spend a while going through every detail carefully. After completing the check of the correctness of the details provided, you will be able to fill out an electronic form and submit your application.

Eligibility Criteria for FAB Personal Loans

| Criteria | Description | For Expats | For UAE Nationals |

|---|---|---|---|

| Minimum Age | 21 years old | Yes | Yes |

| Employment Status | Employed with a reputable organization (government, semi-government, or legitimate private company) | Yes | Yes |

| Minimum Salary | AED 7,000 per month | Yes | Yes |

| Minimum Employment Tenure | 6 months with the current employer (or employment confirmation letter) | Yes | Not Required |

Documents Required for FAB Personal Loans

| Document | Description | For Expats | For UAE Nationals |

|---|---|---|---|

| Application Form | Signed and completed FAB Personal Loan application form | Yes | Yes |

| Signed and completed the FAB Personal Loan application form | An original and valid copy | Not Required | Yes |

| Passport | Showing salary credits (only if the salary is not credited to an FAB account) | Yes | Yes |

| Resident Visa | Original and valid copy (if applicable) | Yes | Not Required |

| Salary Transfer Letter OR Salary Certificate | Issued to FAB and addressed to the bank | Yes | Yes |

| Bank Statements (Last 3 Months) | Showing salary credits (only if salary is not credited to an FAB account) | Yes | Yes |

| Liability Letter OR Clearance Letter (if applicable) | Required for buyout loans only | Yes | Yes |

Types of FAB Personal Loan

1. Personal Loans for UAE Nationals

United Arab Emirates citizens looking for short-term funds, FAB provides a wide range of personal loans through which each customer can choose an option that suits his/her financial condition best. There are several choices one can choose from and one of the basic options is the Salary Transfer loan whose interest rates might be competitive, say as low as 4.74% fixed each year.

The former allows the people to loan the project if AED5 million is the highest amount of loan, and could help in financing a lot of goals. To be qualified, the annual salary should not be less than AED 7,000, and they should be paid into an FAB account.

2. Personal Loans for Expatriates

Expats in the UAE can equally take advantage of FAB’s loan for personal purposes, which may include apartments or cars. The workers who are employed in the Salary Transfer facility will experience competitive interest rates and the minimum salary requirement of AED 15000. This option guarantees financial support in harmony with their needs.

At the same time, the UAE National has more favorable loan terms and they may be different from what is publicly available and may not exist in the case of FAB. Just like under the Emirate residents’ option, applicants carry out the transfer into an FAB account as well.

3. Other FAB Personal Loan Options

A. New to Country/New to Employment Loans

Dedicated to the initial arrivals to the UAE or hires with a new post, such loaning is functional to cater to assimilation or emergent costs. There might be some specific eligibility criteria and conditions to which FAB might apply; therefore, the prospective student is advised to check out in detail to obtain the necessary details.

B. Personal Loan for Self-Employed Professionals & Individuals

Furthermore, FAB is a lending institution that tries to fulfill the financial aspirations of individuals who function as their own employers with this specialized personal loan alternative. Criteria and terms of debate could be quite different when contrasted to the regular choices; hence, it is mandatory to seek help from FAB to get customized assistance.

For customer service

For customer services contact on:

- For customers within the UAE: 600 52 5500

- For customers outside of the UAE: +971 2 681 1511

Additional Considerations

- Interest Rates: FAB tends to offer very competitive interest rates on personal loans of all types. Nevertheless, the interest rate you would qualify for would depend on factors such as credit history, work record, and income status.

- Processing Fees: The federal assistance benefits personal loan from FAB carries a non-recurring disbursement charge.

- Life Insurance: FAB has an option of life insurance with your loan contract. This might give you and your loved ones more peace of mind.

Read Also: List Of Shoe Shops In Dubai Mall.

Benefits of Taking FAB Personal Loan

1. Flexible Loan Amount

FAB Individual Loan allows borrowers to select a loan amount that is just right for their financial demand. FAB aims to provide customers with funds to cover whatever expenses – either small or large – without necessarily taking in the larger sums for major investments.

2. Competitive Interest Rates

Unlike other financial structures, FAB has beneficial interest rates on personal loans that are lower than competitors, which favors guys who opt to borrow. The rates of interest will be determined in different ways, e.g., following the value of the loan mortgages. These factors may include the borrower’s credit risk score, the amount of loan, and the duration of repayment.

3. Convenient Repayment Options

FAB realizes that to ensure debt repayment, a flexible approach to loan repayment is a must. Hence, it provides the borrowers with the ability to repay loans at their convenience choosing tenure that fits their financial one. For instance, there are automated repayment plans of option that help avoid the accumulation of late fees and non-compliance with deadlines.

4. Quick Approval Process

Humanized: FAB Personal Loan is one such avenue that will eliminate all the required complicated procedures and help you to get a loan approval without stress — it is hassle-free. For prompt loan approval, the bank uses the fastest and best-proven mechanisms to avail the capital to customers when it is needed. Indeed, this fast speed of approval is very useful for people who are under pressure to deal with an emergency.

5. No Collateral Required

Albeit securities loans might call for collaterals, the FAB Personal Loan is unsecured, thus lack of pledge assets security as in question. This feature not only extends the loan limit to those with no assets to account for but also looks into other sources of capital to augment the loan portfolio.

Final Words

The conclusion is that getting the FAB Personal loan grants individuals the benefit of a convenient and trustworthy way to meet their financial requirements. Thanks to its comparatively attractive interest rates, an FAB Personal Loan is a go-to option for many mortgagees in need of financial aid. Flexible repayment options and a fast approval process are bonus points.