It is not hard to check the FAB balance when you are familiar with the official procedures. Whether you need to use an ATM, SMS, mobile app, or online banking, First Abu Dhabi Bank offers you several options to view your balance within a short time in the UAE.

This 2026 updated manual covers all the official FAB balance check procedures, such as prepaid cards or salary cards.

Quick Answer: FAB Balance Check

You can check your FAB bank balance using:

- FAB ATM

- FAB mobile app

- FAB online banking

- SMS balance inquiry

- Phone banking

- Customer care

- Salary / prepaid card services

Checking the FAB balance in an ATM is the quickest.

What Is FAB Balance Check?

A FAB balance check enables an account holder to see the available and current balance in their FAB bank account or salary card. This assists in keeping track of salary credits, controlling expenditures, and preventing failed transactions.

Why Checking Your FAB Balance Matters

Routinely monitoring your FAB balance will make you:

- Confirm salary deposits

- Prevent lack of balance problems.

- Track spending

- Pay late Wave card payments.

- Manage monthly bills

All Official Methods to Check FAB Balance

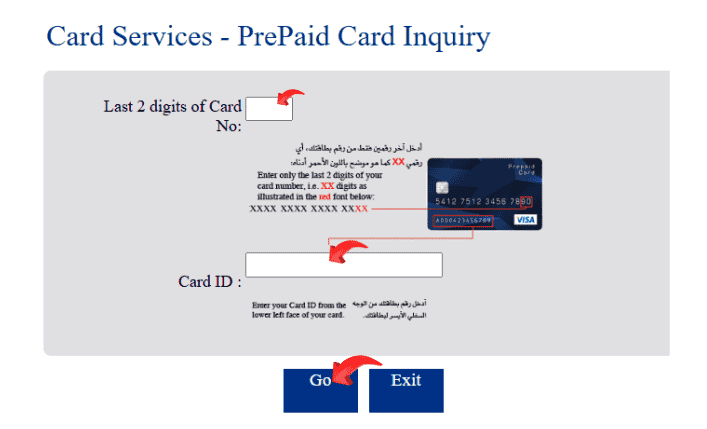

1. Checking FAB Bank Balance Through the Official Website

Step-by-Step Guide

Step 1: Visit the Website

- Go to: ppc.magnati.com

- This page is made up especially to allow prepaid cardholders to check their balance.

Step 2: Enter the Last Two Digits of Your Card Number

- See your FAB prepaid card and fill in the last two digits in the box that is provided.

Step 3: Enter Card ID Number

- Your prepaid card will have the Card ID printed on the front or back surface of your card.

- Put this number in properly.

Step 4: Click the “Go” Button

- After entering all the details, press the button, Go.

- An instant display of your available balance would be given.

Key Benefits

- No login, user-name/password required.

- Convenient and fast for the user of a prepaid card.

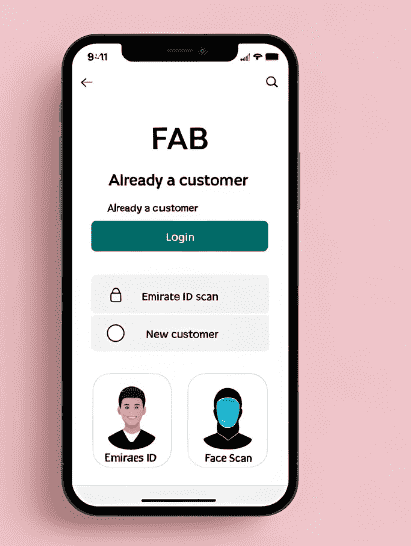

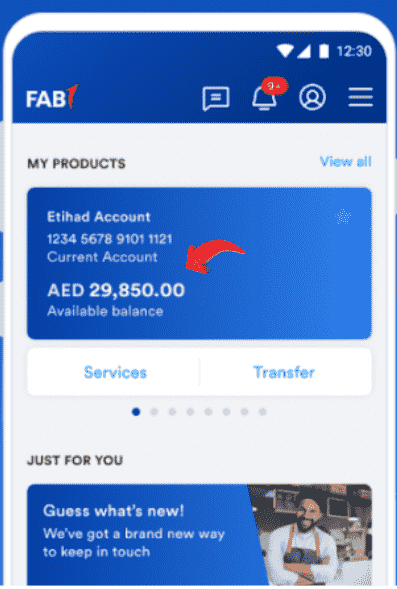

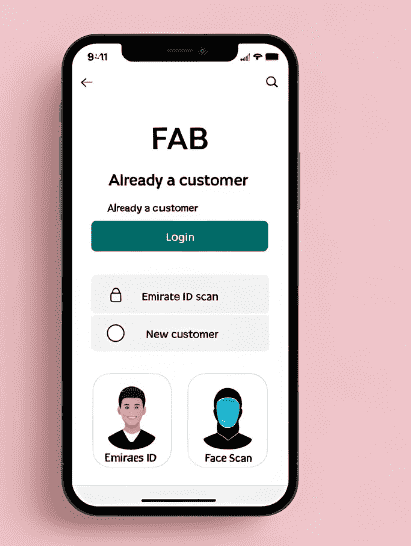

2. Checking FAB Bank Balance Using the FAB Mobile App

FAB Mobile App is an all-in-one tool and a very powerful one too – through this application, you can access all your banking services, check your balance easily.

Download the FAB Mobile App

- Suitable for iOS (Apple App Store) and Android (Google Play Store).

Register or Log In

If You Are an Existing Customer

- Tap “Already a Customer” on the app’s welcome screen.

- Click the app welcome screen icon, saying, Already a Customer.

- Put in your customer number or credit/debit card number.

If You Are a New Customer

- In the Case You Are the New Customer:

- Click on the button, New Customer, and open an account directly in the app.

Check Your Balance

- After you log in, you can normally see the amount in your account on the first screen.

- Alternatively, tap on the “Accounts” tab to see balance details and recent transactions.

- You may also access e-statements to get a more detailed breakdown.

Why I Recommend This

- Real-time updates.

- Secure with biometric verification.

- Provides complete access to the services of the account.

3. Checking FAB Bank Balance via SMS Banking

SMS Banking would be an ideal solution when you need to check your balance using your mobile without accessing the internet.

Step-by-Step Guide

Step 1: Register for SMS Banking

- You should ensure that you have registered your mobile number with FAB.

- You may sign up by using an app, navigating to the site, or visiting a branch.

Step 2: Compose an SMS

- Type the following message:

ABAL 1111

(Replace “1111” with the last four digits of your account number.)

Step 3: Send the SMS

- Send this SMS to 2121 (FAB’s official SMS banking number).

Step 4: Receive Your Balance

- In a few seconds, you will get a response in the form of an SMS stating the balance of your account.

Benefits of SMS Banking

- No internet required.

- Compatible with simple cellphones.

- Fast and reliable.

Read Also: NBAD Balance Inquiry UAE – 7 No-Fee Methods in 2025

4. FAB ATM Balance Check (Fastest Method)

The fastest and most reliable way is to use any of the FAB ATM.

Step-by-Step Guide

Step 1: Locate a FAB ATM

- Search near you with an app or Google Maps to locate the nearest FAB ATM.

Step 2: Insert Your Card

- Use your FAB debit or credit card.

Step 3: Enter Your PIN

- Enter your Personal Identification Number (PIN) consisting of 4 digits safely.

Step 4: Select “Balance Inquiry”

- In the ATM, choose Balance Inquiry or Balance Check.

Step 5: View Your Balance

- Your balance will be shown on the screen.

You may also choose to print a receipt showing your balance.

Advantages

- Secure and straightforward.

- No need for internet or smartphone.

- Available 24/7.

5. Checking FAB Bank Balance by Calling Customer Care

To others who do not feel comfortable talking to someone over the phone, FAB has a Customer Care team that will be willing to help you.

Step-by-Step Guide

Step 1: Dial the Customer Care Number

- From within UAE: Call 600 52 5500

- From outside UAE: Dial +971 2 681 1511

Step 2: Follow the IVR Prompts

- Select the service of Account Services or Balance Inquiry.

Step 3: Provide Required Details

- You might be required to enter your customer ID, debit card number, or account number.

- Enter the verification of identity as prompted.

Step 4: Speak to a Representative (if needed)

- If the automated system doesn’t help, you can press the key to talk to a customer service agent.

- They will assist you with your balance once they identify you.

Why This Option Works

- Better when you want to have a human helper.

- Useful when the problem becomes complicated or when fail-safe approaches are not available.

6. FAB Salary & Prepaid Card Balance Check

FAB salary and prepaid cards also allow balance checks.

Methods Supported

- FAB ATM

- Mobile app (if linked)

- SMS alerts

- Customer support

Salary card users should check balances regularly, especially on salary credit days.

7. FAB Balance Check Using Phone Banking

FAB Phone banking allows fast balance checks.

Steps

- Dial FAB phone banking number

- Verify your identity

- Follow IVR instructions

- Hear your balance details

This method is useful if you don’t have ATM or internet access.

Comparison Table

| Method | Internet Needed | Speed | Best For |

|---|---|---|---|

| FAB ATM | No | Fast | Quick checks |

| Mobile App | Yes | Instant | Daily monitoring |

| Online Banking | Yes | Fast | Full account view |

| SMS | No | Medium | Basic users |

| Phone Banking | No | Medium | No ATM access |

Common Problems While Checking FAB Balance

Balance Not Updated

- Salary credit may take time

- Transactions may be pending

- ATM cache delays can occur

SMS Not Working

- Mobile number not registered

- SMS service not activated

- Network issues

App Login Issues

- Incorrect credentials

- App not updated

- Temporary system maintenance

Frequently Asked Questions (FAQs)

Can I Check My FAB Balance Without Internet?

Yes, you can. Check your balance at any SMS Banking or any FAB ATM without requiring access to the internet.

Is There Any Fee for Balance Inquiry?

Normally, checking the balance via the site, the phone app, or the ATM does not cost anything. SMS charges will, however, be internationally charged in case you are in a foreign country sending SMS in the UAE.

What If I Forget My App Password or Card PIN?

In the FAB Mobile App, you are allowed to reset your password (i.e., follow the link labeled as Forgot Password). In case of ATM PIN, please visit any FAB branch or call customer care.

Is It Safe to Use These Methods?

Yes, FAB guarantees all the methods of balance inquiry are locked and encrypted, in particular, the mobile app that has the benefit of using biometrics as an alternative to the login.

Read Also: X23 Bus Route Dubai: Al Ghubaiba to Intl City Guide

Final Thoughts

As an FAB customer, you can keep track of your account balance in a variety of ways. Be it the FAB website, the FAB mobile app and SMS banking, an ATM, or calling the customer care face-to-face, every option is convenient, fast, and secure.

I would always recommend taking the one that would suit your everyday lifestyle. The FAB Mobile App will become your best mate in case you are a tech-savvy person. In case you are more conservative or are not very sure of smartphones, then ATMs and SMS services are equally effective.