Salik, the renowned toll gate operator in Dubai, presents an intriguing investment opportunity following its public sale in the form of an Initial Public Offering (IPO). The investment in Salik presents a unique opportunity to capitalize on Dubai’s thriving infrastructure and transportation sector. People interested in becoming part of such an opportunity need to understand how IPO investments work and what is unique to Salik.

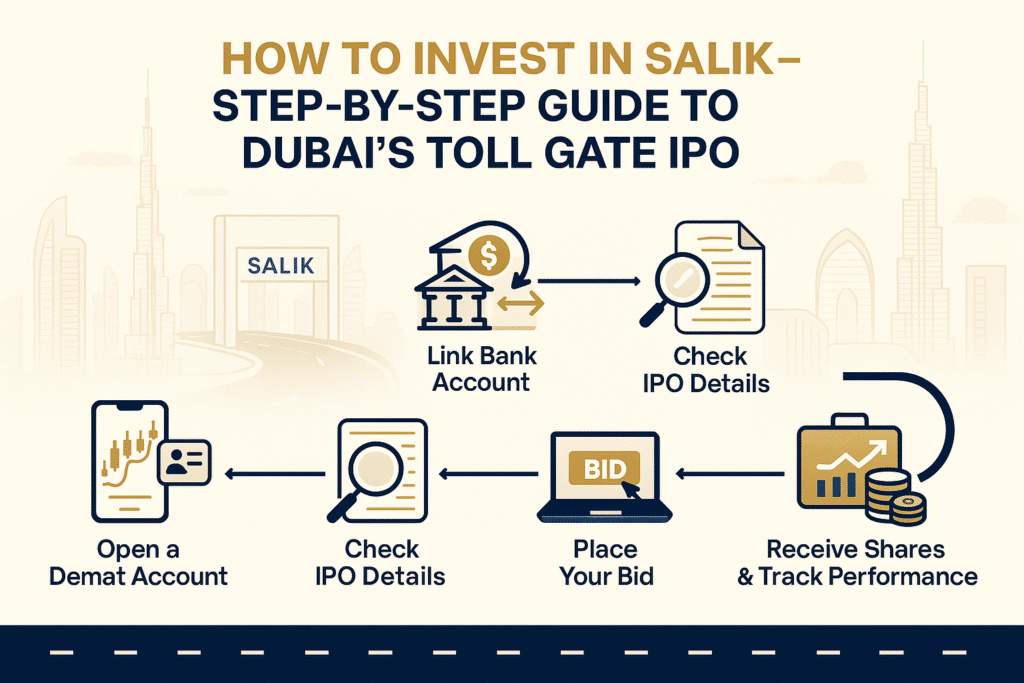

In this guide, you will be explained step by step what to do to ensure a confident investment in the Salik shares at the Dubai Financial Market.

What is Salik?

Salik is a toll gate system that ensures that traffic flows on the busiest roads in the city of Dubai is reduced. Incorporated within the Roads and Transport Authority (RTA), Salik offers a cashless method of toll payments at key passages in Dubai and is an integral part of the city’s infrastructure. Salik is a special investment offering in Dubai with regard to its critical infrastructure and transportation sites.

How to buy Salik shares?

Step 1: Open a Demat Account

A Demat (Dematerialized) account dematerialises your shares, and the process of purchasing, holding, and selling your shares becomes simpler. To invest in the IPO of Salik or any other shares listed in the Dubai financial market( DFM ), a Demat account is mandatory.

How to Open a Demat Account?

- Open a trading account: Open an account with a licensed securities broker in the United Arab Emirates the moment.

- Complete KYC Process: Scan and upload all the needed documents, such as ID proof, Address proof, and bank details, to obtain yourself registered under the full approved KYC process.

- Activate the Account: After the details have been authenticated, the broker will then activate your Demat account, which can be used in trading.

Step 2: Link Your Bank Account to the Demat Account

It is necessary that a linked bank account exists to be able to exchange funds in the IPO bidding process. To subscribe to receive the Black Powder Bulletin:

- Provide Bank Details: When you opt to open a Demat account then it requires you are required to communicate your known bank account information.

- Verify Fund Transfers: This will be the account out of which the funds necessary to execute the bids placed on the IPO shares of Salik will be transferred.

- Easy Withdrawals and Deposits: A bank account enables you to have money deducted when bidding on an IPO and refunded when you do not get it.

Read Also: Termination of Employment in UAE: Your Rights & Responsibilities

Preparing for the Salik IPO

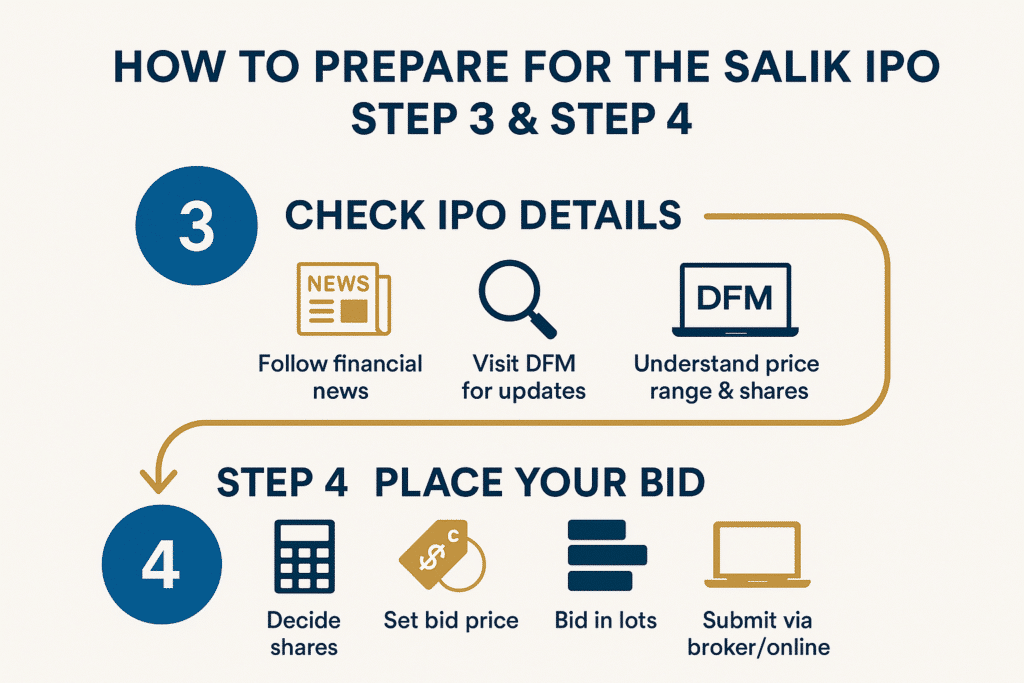

Step 3: Check IPO Details

- Monitor Financial News: Pay attention to trustworthy media resources that provide financial news to monitor the situation on the Salik IPO.

- Visit the DFM Website: The DFM (Dubai Financial Market) website will be displaying official announcements at the time of the IPO, price per share, the total number of shares offered, and the date.

- Understand the Price Range and Share Offering: The IPO is priced usually in a particular range, and the shares to be offered; one should know to decide on how many shares to bid on them.

Step 4: Place Your Bid

As soon as the IPO period starts, you could post a bid via your Demat account or broker to purchase Salik shares.

How to Place Your Bid?

- Determine the Number of Shares: Calculate the number of shares you are willing to invest in after considering the amount you are ready to invest and the amount of risk you are willing to take.

- Specify the Bid Price: Bid price within the stipulated range by the IPO. In most cases, you would be able to make a cut-off bid, which means you will accept the final IPO price or a price-specific bid.

- Bid in Lots: Lots. In most IPOs, you have to buy the shares in lots, which is a grouping of shares. Be sure to get acquainted with the Salik lot size so as not to make mistakes.

- Submit Through Your Broker or Online Platform: Place your bid via the broker or directly via an online trading platform via your Demat account.

Step 5: Allotment and Payment

In case your bid is successful, the following takes place:

- Share Allotment Confirmation: Differing needs and other factors will be considered in the allotment of shares to Salik.

- Fund Transfer for Allotted Shares: The amount will be deducted by the necessary installment directly to your bank account. Ensure that you have adequate capital that fund the value of the shares.

After the IPO: Managing Your Salik Investment

Step 6: Receive Shares in Your Demat Account

When the IPO process is complete, you will be allotted shares, which will be credited directly to your Demat account.

- Check Your Demat Account for Shares: After a few days of the IPO, you can log in to your Demat account and verify to see that shares have been credited.

- Begin Tracking Salik’s Performance: You can then follow up on the performance of Salik on the DFM and make informed decisions on whether to hold or sell.

Additional Tips for Investing in Salik

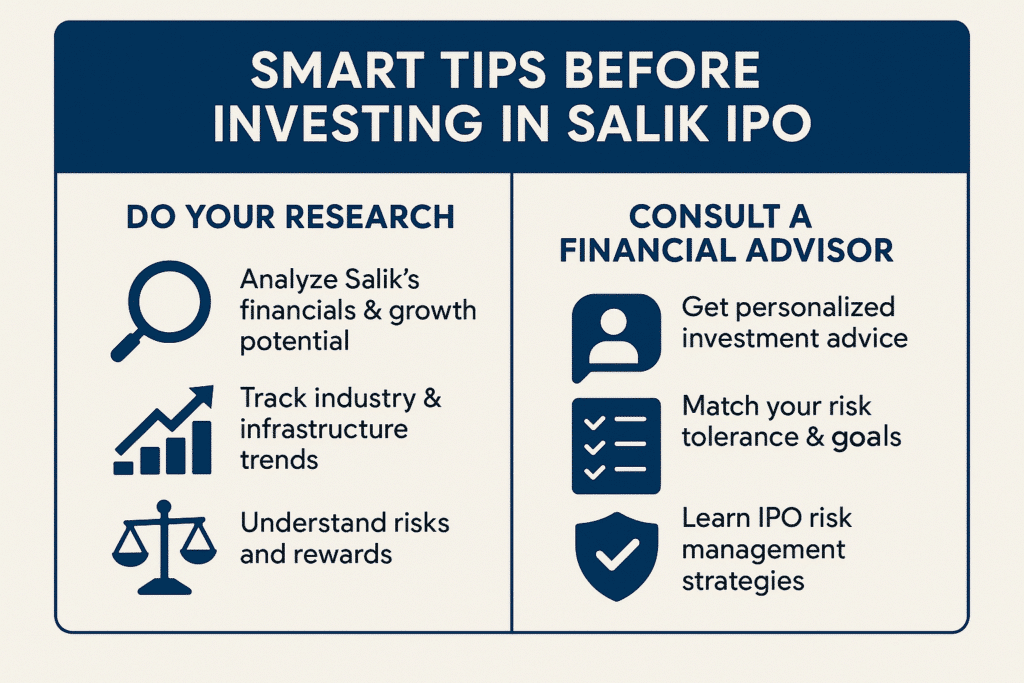

1. Do Your Research

Making an investment decision without understanding the business model, finance, and prospects of Salik will be wrong in any case.

- Analyze Financials and Growth Potential: Examine Salik in terms of its earnings, revenue, and growth prospects to get an idea about its long-term potential.

- Industry Trends: Monitor industry trends, particularly those pertaining to the transportation and infrastructure industries, and see how Salik is faring within the industry.

- Potential Risks and Rewards: There are aspects that could affect the performance of Salik both positively and adversely, and you have to be prepared in case market conditions vary.

2. Consult a Financial Advisor

It can be greatly positive to ask a financial advisor when you are new to the world of IPOs or the stock market in general.

- Personalized Investment Advice: A qualified advisor can give both risk and financial advice based on your investment preferences, risk tolerance, and financial aspirations.

- Risk Management: They can assist you in comprehending the risks that IPO investments pose and give you suggestions on the tame to manage them.

3. Diversify Your Portfolio

Do not invest all your capital in one venture, so Salik, although it appears to be a good deal, should not be taken as the only investment you make.

- Spread Investments Across Sectors: Include a variety of industries, asset classes, and locations so that the risks will be spread out.

- Balance High and Low-Risk Investments: Balancing the high-growth stocks, which are usually risky investments such as IPOs, and stable investments can make the returns predictable.

- Long-Term Perspective: By maintaining a wide portfolio of investments over time, it is also possible to have more stability and experience growth.

Read Also: Is Pornography Allowed in the UAE? Shocking Truth You Need to Know

Final Note

Participation in the IPO of Salik is the chance to have exposure to a critical infrastructure in Dubai. By completing these steps- opening a Demat account and linking your bank account, bidding, receiving allotments, and managing your shares, you will emerge fulfilled and ready to go into the Salik IPO.

Investing in Salik can be a successful addition to your portfolio with the right preparation, research, and astute decision-making.