Direct remit or direct deposit is a form of an electronical transfer of money between accounts. It is heavily underutilised across all sectors of transaction such as in receiving payments as part of the payroll, government benefits, investment returns, or in bill payment. It removes the use of paper checks and physical transactions thus being quick, safe, and also efficient in the transfer of money.

In this blog I am going to break down What is Direct Remit, how it works and its many benefits. At the conclusion, you will be fully equipped with how direct remit can enhance your financial transactions.

What is Direct Remit?

Direct remit is simply an electronic financial transfer of money. transferred from one account to another. This can also be done without having third parties in the waiting like check clearinghouses or even physical banks. The mechanism is most often employed to make regular payments like salaries, governmental benefits, etc. Direct remit transfers funds in digital format, unlike traditional banking methods and thus, direct remit is faster, more secure, and convenient.

Key Points about Direct Remit:

- No Intermediaries: There are no third parties involved in transactions, and this occurs between accounts.

- Common Usage: Usage may be in the form of payroll, government benefits, dividends, and payment of bills.

- Cost-Effective: Saves on time and financial resources as opposed to other methods of making transactions, like the use of checks.

How Direct Remit Works

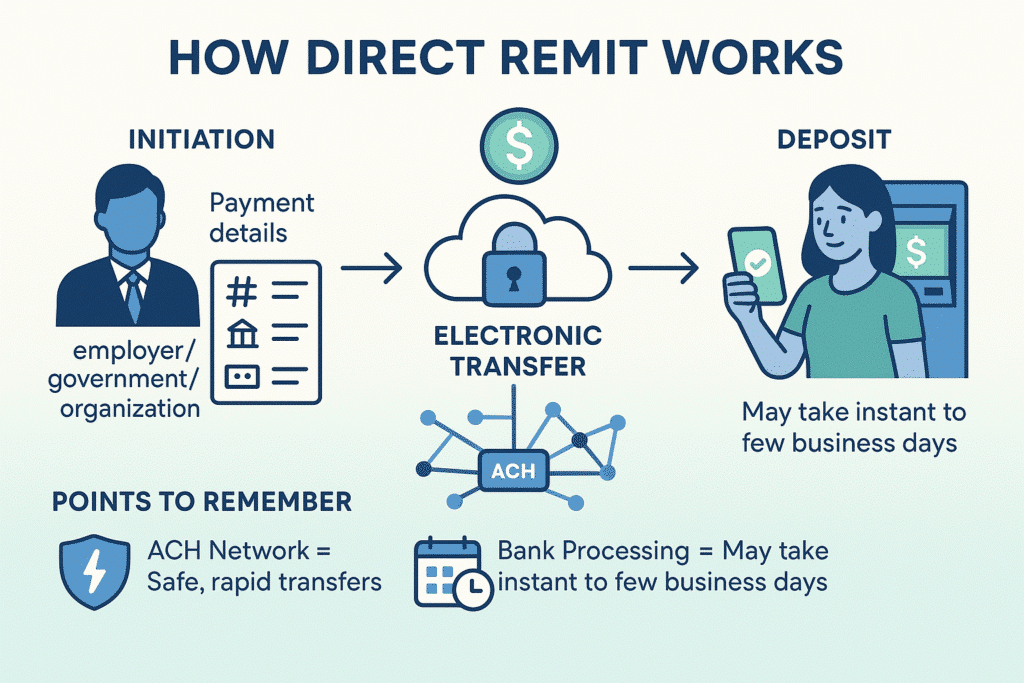

The initiation of any direct remit transaction is very crucial. The recipients will require banking information of their senders, who are very likely to be an employer, a government agency, or an organization. This information comprises in part:

1. Initiation

The first step in any direct remit transaction is the initiation. The sender, usually an employer, government agency, or organization, will need the recipient’s banking information. This information includes:

- The account number received

- The name of the bank

- The information about the routing number (a number identifying the financial institution)

Once this information is obtained, the sender fixes the payment to be paid electronically.

2. Electronic Transfer

After initiating the payment, the money is. electronically transferred It is like a sender who sends money out of his/her account to the recipient’s account. This is achieved by an automated clearing house (ACH) network, similar to the previous one, and allows financial institutions to make electronic payments.

3. Deposit

The last step is the transmittal of the payment by the bank of the recipient and depositing it to the account of the recipient. Depending on the system, the monies can take as quickly as instant or a few business days. The recipient is at liberty to make withdrawals of the money as he or she would do with any other deposit.

Points to Remember:

- ACH Network: These are normally done through ACH, guaranteeing safe, rapid, and correct transfers.

- Bank Processing: Not all of the banks are processed quickly, and therefore, the availability of the funds could very well be a problem.

Benefits of Direct Remit

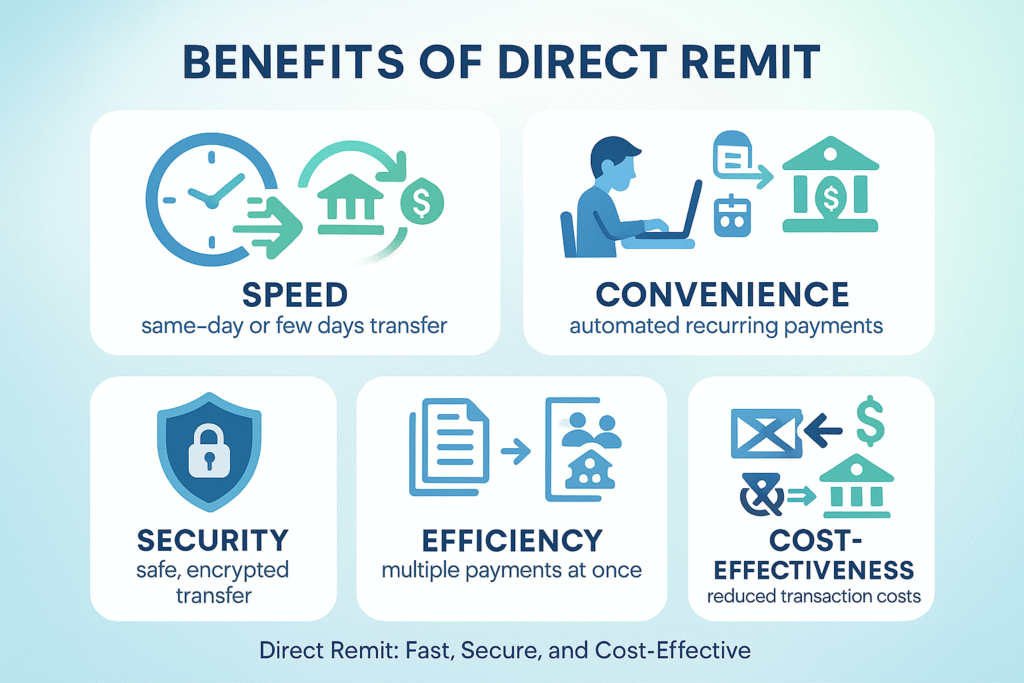

Direct remit has numerous benefits hence which reason why most companies, governments, and individuals will want to conduct their financial transactions using this method. The most remarkable advantages are:

1. Speed

The major strength of direct remittance is that it is faster. Traditional checks may take days and even weeks to be processed, cleared, and deposited into a recipient account. Funds are sent as quickly as possible with direct remit. In the majority of instances, money arrives in the account of the recipient within a few business days or even on the same day.

2. Convenience

Offline remit also eradicates the costs of visiting the bank and getting the checks mailed to your home. It is also easy to set recurring payments and forget them, knowing they will be automatically deposited in your account without your manual input.

3. Security

Because direct remit occurs on a digital level, it eliminates a large portion of the risk that is associated with misplaced or stolen checks. You need not be worried about how the checks are misplaced in the mail or into the hands of the wrong stranger. In addition, it is encrypted and conducted over secure channels in the process of electronic transfer to confirm that the transaction is not prone to fraud.

4. Efficiency

Direct remit is efficient in terms of businesses by allowing many payments to be made at the same time. Payrolls could be run with a few clicks, and bills or government benefits could be made without manual processes that could take a long time. The whole process can be automated, which is efficient in the operations and eliminates the likelihood of human error.

5. Cost-Effectiveness

The other key benefit is the affordability of direct remittance. Delivery of checks is accompanied by the costs of delivering the checks through postage, printing, and processing. Direct remit also cuts out much of these costs, an aspect that makes it a cost-effective option to businesses and individuals alike.

Key Benefits at a Glance:

- Fast Processing: Transactions are faster than the traditional ones..

- Convenient: There is no need to operate with paper checks or visit the bank.

- Secure: Reduce fraud or theft.

- Efficient: Useful in the case of recurrent payment.

- Affordable: Saves the costs of transactions.

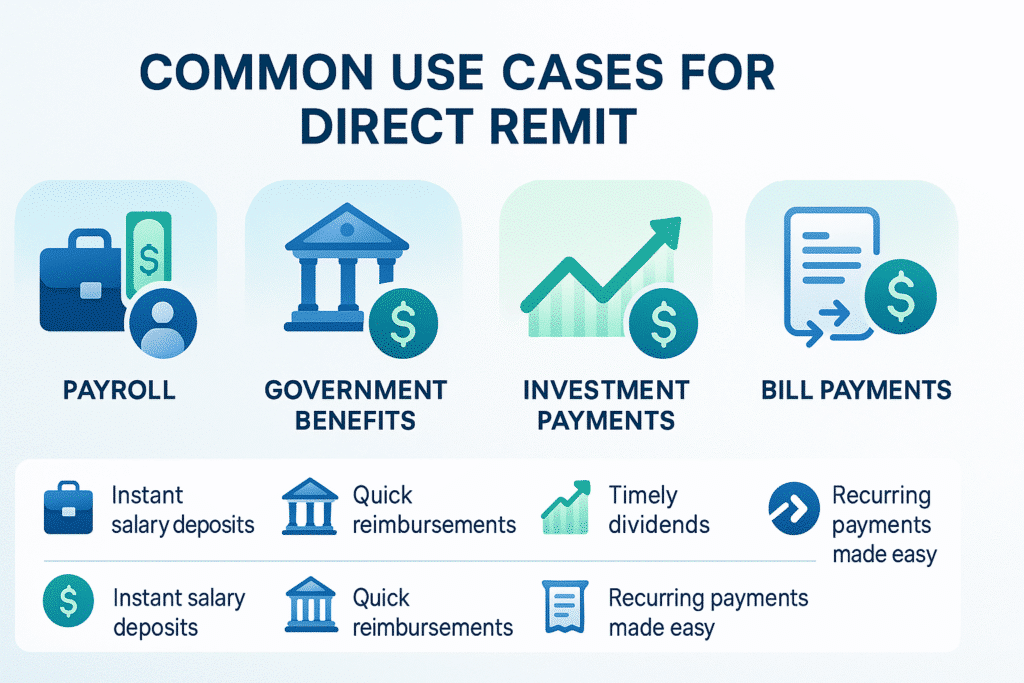

Common Use Cases for Direct Remit

Direct remit applies to many sectors in a great number of ways. Common use cases are the following:

1. Payroll

Direct remit is used by a lot of businesses as a payroll payment option. Instead of issuing and giving employees physical checks, employers can transfer workers’ salaries to their bank accounts. The workers have convenient, swift access to their salaries without having to go to the bank and wait until their checks are cashed.

2. Government Benefits

Direct remit is used by governmental bodies when it comes to handing out social security funds, job benefits, pensions, and other areas of financial support. The recipients get the advantage of fast access to their funds, which can be important to those depending on government support.

3. Investment Payments

Investors can be remitted dividends, interests, and profits. This enables them to withdraw the returns of their investments promptly and without the time-wasting hassles of manual processing.

4. Bill Payments

Direct remit is a service whereby customers can make their payments directly out of their bank account to the company. An example is with utilities or subscription services: a customer can request to be put on automatic payment, and any monthly due amount is automatically deducted from their bank account.

Use Cases Overview:

- Payroll: Employers are able to instantaneously handle their wages.

- Government Benefits: This is in order to reimburse funds.

- Investment Returns: Investors receive their dividends on time.

- Bill Payments: The company makes Direct remittance of recurring bills.

How to Set Up Direct Remit

Establishing a direct remit is quite an easy task. No matter who you are, whether you are an employer, an individual, or a recipient, the process is easy. This is how you may configure it:

1. For Employers

IAs an employer wishing to establish the direct remit option to payroll, you should have:

- Employee Banking Information: Bank names, account numbers, and routing numbers.

- Payroll Software: The majority of payroll programs can allow configuration of direct deposit.

- Authorization Forms: Employees can be required to fill out an authorization form when they want their wages to be directed to their account.

2. For Individuals

As an individual setting up direct remit, you are likely to require:

- Bank Account Information: State your account details to the person paying (e.g., employer, government agency).

- Authorization Form: Direct remit may require that you complete and submit an authorization form to initiate the transaction.

3. For Recipients

There is little to do by the recipient of a direct remit transaction. All you need to do is indicate your banking details to the payer, after which the amount will automatically be available in your bank account when a transaction is made.

Steps Recap

- Employers: require employee banking details and payroll software.

- Individuals: Provide account information to the payer.

- Recipients: Just wait, and see the funds in their account.

FAQs

What is Direct Remit?

A fast, secure, and fee-free money transfer service.

How fast are transfers?

Instant international transfers in most cases.

Are there fees?

No, Direct Remit is 100% fee-free.

Which countries can I send to?

Send money to India, Pakistan, the Philippines, and more.

Final Words

Direct remit is a needed financial instrument in the modern age of the accelerated and digital environment. Regardless of whether you use it to receive your wages, government benefits, or investment income, the practice has many advantages over the conventional process of dealing with paper checks. Direct remit is taking over the traditional methods of transactions due to speed, convenience, security, and cost-effective operations.

With the knowledge of the way direct remit works and how it can be helpful in managing your finances in a secure and efficient manner, it will help you do so better.