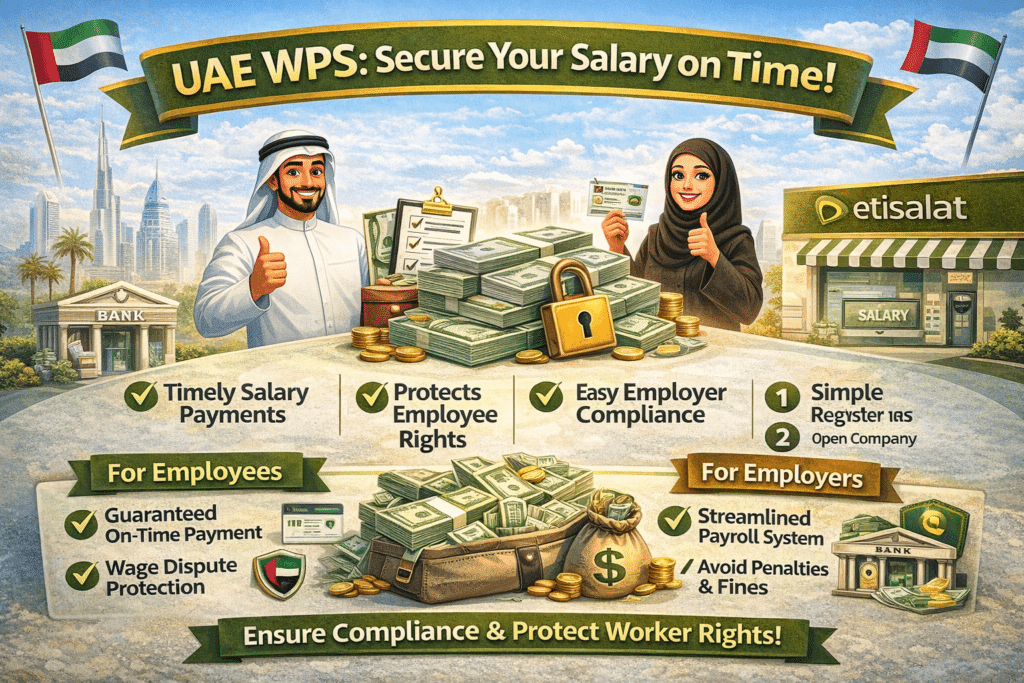

The United Arab Emirates (UAE) has a program known as the Wage Protection System (WPS), which is a government-mandated program designed to take care of the employees in the private sector and to make sure that their wages are paid in full and on time. Such a jointly managed system with the assistance of the Central Bank of the UAE (CBUAE) is founded on the electronic payment system that facilitates the wage payment process, which ensures the rights of employees are safeguarded, and the payroll policies are more transparent.

In this step-by-step guide, I will show you all you should know about the WPS in the UAE, including its purpose, its benefits, the requirements that must be met by the employer,s and all the steps of enrolling.

What is WPS?

The mission behind WPS was clear, since it aimed at developing a fair, reliable, and accountable wage payment system for the entire employees of the private sector in the UAE. This system assists the government in tracing and enforcing the labor laws and ensures that the employees get paid on time, and minimizes the wage-related issues.

The major reasons of adopting WPS are:

- Protecting Employee Rights: The UAE government is interested in defending the rights of employees by paying them all the wages they are entitled to, and at the right time.

- Enhancing Transparency: WPS enhances salary payment transparency that minimizes the likelihood of miscommunication and conflicts between employees and employers.

- Cutting the Financial Risk: Another benefit of WPS is that the employers are unable to refuse or postpone payments to employees in an unfair manner, therefore lessening the financial difficulty employees might suffer.

Mandatory WPS Requirements for Employers

WPS applies to all companies in the UAE with operations in the private sector, whether small or big, and irrespective of their industry. This involves companies found in free zones. Employers are required by law to enroll in WPS and make use of this as the only method of paying the wages to their employees.

Penalties for Non-Compliance

The government of the UAE applies rigorous sanctions on companies that do not meet the requirements of WPS. The non-compliant employers can be subject to:

- Fines: The companies may pay fines because of either failure to pay wages with the WPS or failure to pay them promptly.

- Limitations on Business Operation: MOHRE will have the capacity to limit businesses that fail to meet WPS, such as freezing work permits of new employees.

- Legal Action: In severe cases, repeated violations of WPS rules may lead to additional legal actions against the company.

Compliance Monitoring

WPS is utilised by the government to track payments of wages in the private sector in the UAE. WPS provides detailed reports to MOHRE and CBUAE, following these institutions to ensure that all the companies comply with labor laws. Employers are required to provide monthly payrolls on the salaries, allowances, deductions, and net remuneration of employees.

How WPS Works: Step-by-Step Process for Employers

WPS is based on a set of steps that employers should adhere to in order to make successful payments to the salaries. The following is a detailed analysis of the stages of the WPS process:

Step 1: Employer Registration

Employers have to be registered initially by MOHRE and the Central Bank of the UAE. This involves:

- Getting a MOHRE Approval: The employers should submit their requests to MOHRE to be registered with WPS and submit all the required information about their company and employees.

- Establishing a connection with CBUAE: To gain access to the WPS platform and register, the employer will have to cooperate with the Central Bank of the UAE.

Step 2: Creating a Salary Information File (SIF)

Employers are obliged to create a Salary Information File (SIF) containing the following information when they are registered:

- Employee Information: Full names, nationalities, job titles, and date of employment.

- Banking Information: Bank account details of the employees, including the salary amount, the allowances, or any deductions.

- Monthly Salary Data: The SIF holds all salary information of every employee that MOHRE looks into to ensure that all employees work within the UAE labor laws.

Step 3: Submitting and Validating the SIF

After preparing the SIF, employers submit it to MOHRE and the Central Bank for validation. During this step:

- Data Verification: MOHRE and CBUAE validate the data to ensure the employer’s payroll aligns with the labor laws.

- Compliance Check: Both organizations review the file to check for any discrepancies or violations.

Step 4: Salary Disbursement via WPS Agents

Upon successful validation, employers transfer the necessary funds to the employee bank accounts through authorized WPS agents. These agents, approved by MOHRE, facilitate the actual payment process.

- Transfer Process: Employers give wages to the WPS agent, who in turn pays salaries to the accounts of employees.

- Confirmation of Payment: A confirmation that the transfer has been completed and the salary is being paid is given to the employers.

Benefits of WPS for Employers and Employees

Ensures Timely and Accurate Salary Payments

The primary advantage of WPS is that it ensures the employees get their salaries in time and in full. Late payments of salaries may cause financial strains on the employees, particularly those earning low salaries and therefore this system limits this and the workers receive their salaries on time.

Protects Employee Rights

The UAE government is very active in tracking and implementing the payment of wages through WPS, and ensures that the employees are paid in accordance with their contracts. This controls the exploitation of workers and non-payment of salaries, encouraginga safe and healthy workplace.

Transparency and Accountability

WPS is more transparent as a thorough tracking of salary payment of the individual is done, which reduces the possibility of conflict between employers and employees. Employees can confirm their earnings with a clear record,s and the employers can know the money paid in terms of payments.

Streamlines Payroll Management

WPS also offers an effective method of payroll administration to employers. Through a safe and government-approved system, employers are able to make their payments in the form of salary without necessarily dealing with money or other manual payment systems. This minimizes administrative activities and enhances a smooth and compliant payroll operation.

Enhanced Security and Reliability

WPS involves safe electronic transfer, and this minimizes the chances of fraud or mistakes. The employees and employers alike enjoy a secure and efficient system of wage payment due to the automation of the payment process.

How to Enroll in WPS as an Employer

To become a successful enrollee in WPS, employers have to answer several basic questions. We will discuss each of them:

Step 1: Register with MOHRE

The employers have to be registered by WPS by applying to MOHRE, attaching the required documents concerning their business and employees.

- Approval required: Seek the approvals and fill in any other requirements as stipulated by MOHRE.

- Paperwork: The employers are to provide business licenses, contracts with the employees, and other documentation.

Step 2: Open a Corporate Bank Account

To take part in WPS, employers are required to have a corporate bank account with a bank located in the UAE that would facilitate WPS transactions. This is necessary since the WPS platform involves an electronic bank transfer, which is a secure payment method.

Step 3: Appoint a WPS Agent

Employers need to appoint an authorized WPS agent, usually a bank or financial institution approved by MOHRE, to facilitate the salary transfers.

- Selection of agent: Select a WPS agent that will fulfill the needs of your company and help with processing salaries in the most efficient way.

- Service Agreement: Develop a service contract with the WPS agent where roles and responsibilities are defined with regard to the management of payroll.

Step 4: Prepare and Submit the Salary Information File (SIF)

After registering the employer, he or she has to prepare the SIF, which is a document that holds comprehensive information on the salary and banking details of every employee.

- File Preparation: Use payroll software compatible with WPS guidelines to prepare the SIF.

- Submit the File: Submit the completed SIF to MOHRE and CBUAE for verification.

Step 5: Salary Disbursement

After validation, the WPS agent will begin disbursing salaries to each employee’s bank account as specified in the SIF. Employers must repeat this process each month to remain compliant.

Read Also: How to Renew Your Ajman Driving License: Easy, Fast, and Secure

Final Words

WPS is a crucial system in the UAE that guarantees defense by the private sector to have their salaries paid in a timely manner and according to their contracts. WPS contributes to the creation of an equitable and responsible labor market in the UAE by making electronic payments and clear records, and ensuring compliance. To the employers, WPS simplifies the payroll processes, reduces the administrative workload, and enhances trust among the workforce. To the employees, WPS offers security as it safeguards their rights and creates a good working environment that is transparent.

As an employee seeking to know what is entailed by wage rights or an employer with the aim of getting into the terms of the UAE labor regulation, WPS is a critical mechanism in ensuring that there is a balanced workplace.