Dubai Islamic bank (DIB) provides the customer with a variety of financial services, including debit card services that are tailor-made to suit the different needs of the customer. After getting your debit card DIB, you need to activate it first; otherwise, you cannot start enjoying its benefits.

In this guide, I’ll will take you through the hassle-free way in which you can activate your Dubai Islamic Bank debit card.

Dubai Islamic Bank (DIB)

Dubai Islamic Bank is the pioneer bank that has integrated the principles of Islam in all its practices. Founded in 1975, DIB was developed to be one of the largest Islamic banks in the world with a high level of Sharia-conformed products and services.

DIB debit card is a convenient payment system where customers can shop, withdraw cash, and do all their financial operations with it. We should now focus more on how to acquire this most important banking weapon.

How to Apply for a DIB Debit Card

The procedure of applying a DIB debit card is not a complex one, and it can be completed using online or offline applications. The steps to both methods are outlined below.

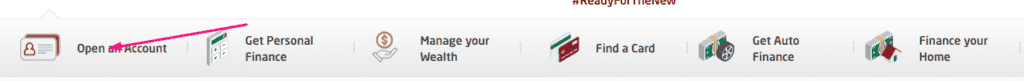

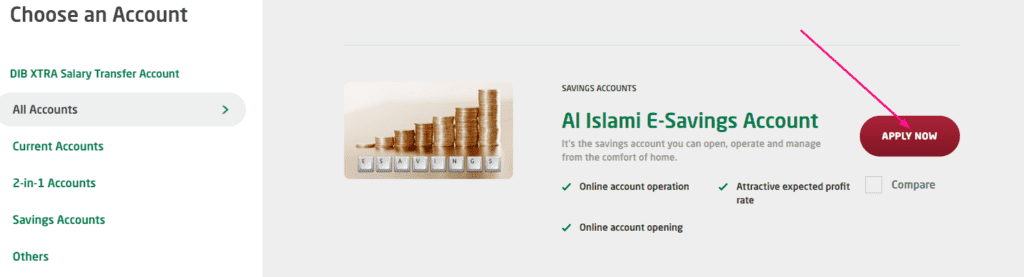

Online Application Process

- Visit the Dubai Islamic Bank website.

- Go to the section of debit cards and select the one that suits you best.

- Complete the online application form by clicking on the button of application button and following the instructions.

- The necessary documents, including the Emirates ID and evidence of address, will have to be uploaded.

- Check over and send in your application.

Offline Application Process

- Go to the closest branch of the Dubai Islamic Bank.

- Discuss with a bank manager and state that you are interested in the application for a debit card.

- Complete the application form provided by the bank with all correct and current information.

- Submit the filled form with the needed documents to the bank officer so that it can be processed it.

How to Activate a Dubai Islamic Bank Debit Card

The process of activating a debit card of Dubai Islamic Bank is a simple one, and this can be done in many ways.

Activating Offline via ATM

The ATM is one of the most used ways to use your DIB debit card offline. Follow these simple steps:

- Swipe your new DIB debit card at any DIB or partner ATM.

- Enter your PIN when prompted.

- Your card will become available when it is activated successfully.

- Upon successful activation, your card will be ready to use.

Activating via Online Banking

In case you want ease, internet banking, you have a DIB debit card that you can enable using the DIB online banking portal. Here’s how:

- Click on your DIB online banking account.

- Go to the section of card activation.

- Enter your card details as prompted.

- Carry out the instructions on the screen to carry out the activation process.

Activating via Mobile App

DIB equally provides easy-to-use mobile application software so that one can conveniently bank anywhere. To make your debit card work on the mobile application:

- Download and install the DIB mobile app from your App Store or Play Store.

- Log in or create an account in case you are a new user.

- Navigate to the card activation section.

- Follow the prompts to activate your debit card.

Customer Support Assistance

You can always contact the customer care team of DIB in case you have any concerns or need the help of DIB with the operation of your DIB debit card. You may call them or email or visit your nearest branch of DIB to seek their help in person.

Security Tips

When using your DIB debit card to make transactions, remember to prioritize security to protect your finances. In this case, here are some security tips:

- Do not give your PIN or card numbers to anybody.

- Regularly monitor your account for any suspicious activity.

- Lost or stolen cards should be reported to prevent any unauthorized use.

- Allow real-time alerting of card activity.

Benefits of DIB Debit Cards

DIB debit cards have numerous advantages, such as:

- Convenient cashless transactions.

- Worldwide acceptance at millions of locations.

- Enhanced security features for peace of mind.

- Access to exclusive discounts and offers.

Features

The DIB debit card is packed with a lot of features that help to improve your banking experience. These include:

- Sharia-compliant transactions: All the transactions conducted in the DIB debit card are according to the Islamic principles.

- Worldwide acceptance: The card can be used to buy or withdraw funds at millions of points around the globe.

- Contactless payment: Take advantage of contactless payment and make fast and secure payments.

- Online banking: Access your account online to check your balance, view transactions, and manage your card settings.

- Rewards program: Get reward points on every purchase you make using your DIB debit card.

Using Your DIB Debit Card

After receiving your DIB debit card, you can start using it in different transactions, and these include:

- Withdrawing cash from ATMs

- Making purchases at retail stores, restaurants, and online merchants

- Paying bills and utilities

- Transferring funds between accounts

Managing Your DIB Debit Card Account

To make good use of your DIB debit card, the following tips can be taken into account:

- Check the balance of your account periodically to keep track of your expenditure.

- Establish transaction and account update notifications.

- Always ensure that your card details are kept safe and report any suspicious transactions to us.

- Should you lose or steal the card, call the customer service of Dubai Islamic Bank and block the card and have a replacement.

Review and Approval

After the application is received, the applicants also have a short wait time during which the bank is going to verify the information provided by them. Applicants will receive notification on the status of their application, that is, approved or rejected, once the application is processed.

Read Also: Best Affordable Restaurant in Abu Dhabi: Top Picks & Deals.

Receiving the Debit Card

Successful applicants can get their DIB debit card by way of different delivery options, such as by mail or picking the card at the nearest branch of DIB. When the users get the card, they are required to get it activated by undergoing a simple verification process before use.

Managing Your DIB Debit Card

The online banking system of the bank provides ease in managing a DIB debit card. Customers have the opportunity to use their Personal Identification numbers (PIN) and set transaction limits as they want them to be. Moreover, DIB also offers 24-hour customer service to help with any card-related problems or queries.

Security Measures

DIB has stringent security control that covers the safety and security of transactions. Users should adopt best practices like ensuring that they protect their PIN and report about missing or stolen cards to the bank.

Final Words

To get the most of your debit card and Dubai Islamic Bank, it is a very basic but important process to activate your bank card. You may activate it in an ATM, online banking, or the mobile app, but be assured that DIB offers them the convenient options to use them your way. Start now and experience hassle free banking using DIB debit cards.