Closing Mashreq Bank Account can sometimes be as daunting as opening one, especially when it comes to navigating the procedures and requirements set by the bank. If you’re considering closing your Mashreq bank account, fear not!

In this comprehensive guide, I will walk you through the process step by step, making it as simple as possible.

About Mashreq Bank

Mashreq Bank, headquartered in Dubai, has been serving customers in the UAE and beyond for decades. With a strong commitment to innovation and customer service, Mashreq Bank offers a variety of banking products and services, including accounts, loans, credit cards, and more.

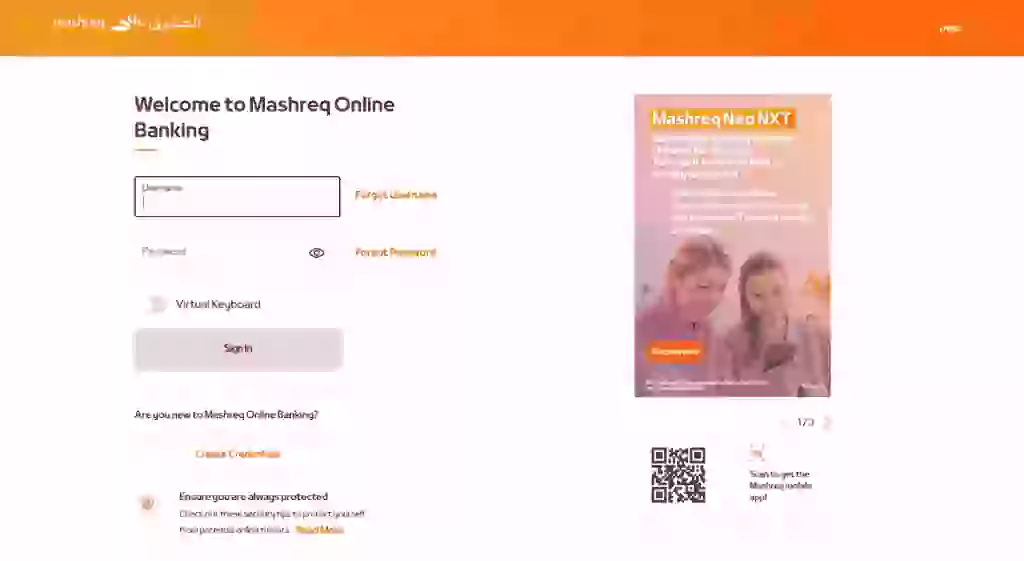

Mashreq Mobile App/Online Banking

1. Logging In

To begin the process of closing your Mashreq bank account ( https://www.mashreq.com/en/uae/neo/ ) , you’ll first need to log in to either the Mashreq Mobile App or the Online Banking platform. If you’re using the app, enter your username and password in the designated fields. For online banking, navigate to the Mashreq website and log in using your credentials.

2. Accessing Settings

Once you’ve successfully logged in, navigate to the “Settings” menu. This can usually be found in the app’s sidebar or at the top of the screen. In the online banking platform, look for a similar section labeled “Settings” or “Account Preferences.”

3. Initiating Account Closure

Within the “Settings” menu, you should find an option titled “Close Account” or something similar. Click on this option to begin the account closure process. Mashreq may require you to verify your identity again at this stage for security purposes.

Branch Visit

1. Branch Locator

You can easily find this information by using the Mashreq website or mobile app. Simply enter your current location or desired area, and the app will provide you with a list of nearby branches along with their addresses and contact details.

2. Visit the Branch

Once you’ve located the nearest Mashreq branch, it’s time to visit them. You can either schedule an appointment beforehand or simply drop by during operational hours. Be sure to check the branch’s working hours in advance to avoid any inconvenience.

3. Request Closure

Upon reaching the branch, approach a customer service representative and inform them of your intention to close your Mashreq bank account. They will guide you through the necessary steps and assist you throughout the process.

4. Documentation

To initiate the account closure procedure, you’ll need to provide some documentation for verification purposes. Make sure to carry your Emirates ID or passport along with any relevant bank documents, such as your account statement or debit card.

Required Documents and Information

- Proof of Identity: Your Emirates ID or passport.

- Bank Account Details: Your account number and type.

- Closure Request Form: You might need to fill out a formal account closure request form, depending on the chosen closure method.

5. Closure Form

In some cases, you may be required to fill out and sign a formal account closure request form. This form typically includes details such as your account number, personal information, and reason for closure. Be sure to complete the form accurately and truthfully to avoid any delays in processing.

5. Confirmation

Once you’ve indicated your desire to close your account and provided any necessary information, you’ll be prompted to confirm your request. Follow the on-screen prompts to complete the process. Mashreq may also provide you with additional information regarding any outstanding balances or pending transactions on the account.

Mashreq Customer Service

For any further inquiries or assistance during the account closure process, you can contact Mashreq customer service through the following channels:

- Phone: Call Mashreq’s customer care hotline at 00 971 4 424 4444.

- Email: Send an email to Mashreq’s customer service email address ( janed@mashreq.com ).

- Branch Visit: Visit a Mashreq branch and speak with a customer service representative.

Read Also: Gold Shops In Dubai Mall: Best Picks & Trends

Closing Procedures

1. Clear Outstanding Balances

Before closing your Mashreq bank account, ensure that there are no outstanding balances or pending transactions. Clear any dues, such as outstanding loans or credit card payments, to avoid complications during the closure process.

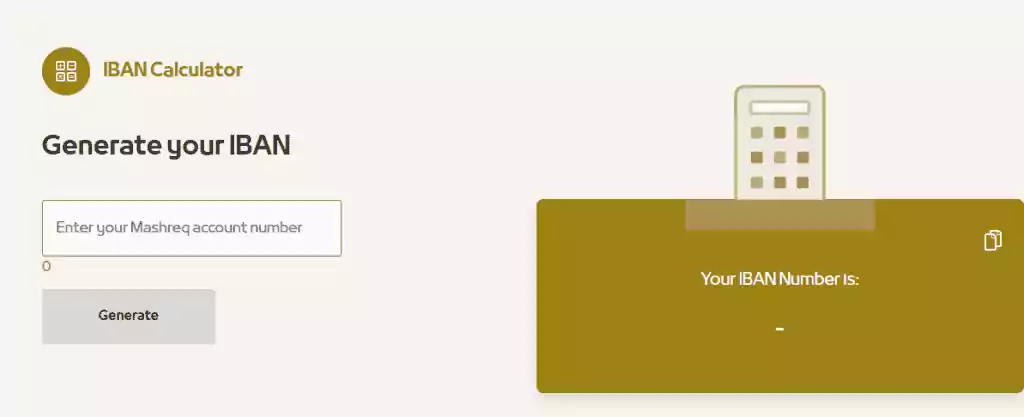

2. Transfer Funds

If you have any remaining funds in your account, transfer them to another bank account or withdraw them in cash before closing your Mashreq account. This will prevent any loss of funds and streamline the closure process.

3. Return Debit Cards and Cheques Books

As part of the closure process, you may be required to return any unused debit cards or checkbooks associated with your Mashreq account. Make sure to hand these items over to the bank representative during your branch visit.

4. Confirm Closure

Once you’ve completed all the necessary steps and provided the required documentation, the bank will initiate the closure process. You may receive a confirmation letter or email once your account has been successfully closed. Be sure to keep this documentation for your records.

Additional Points to Consider

Account Inactivity Fees

Be aware of any potential inactivity fees associated with your Mashreq bank account. If your account remains inactive for a certain period, these fees may apply. Refer to Mashreq Bank’s website or contact customer care for detailed information regarding inactivity fees.

Dormant Accounts

If your Mashreq bank account remains inactive for an extended period with a zero balance, it may be classified as dormant. Reactivating a dormant account involves specific procedures that differ from standard closure processes. Contact Mashreq Bank directly for guidance on reactivating dormant accounts.

Loan Accounts

It’s important to note that this guide primarily focuses on the closure of deposit accounts (such as savings or current accounts). If you have loan accounts (such as personal loans or mortgages) with Mashreq Bank, the closure process may vary. For specific instructions on closing loan accounts, it’s advisable to reach out to Mashreq Bank for guidance.

Considerations and Tips

Clear Any Outstanding Balances

Before initiating the closure process, it’s crucial to clear any outstanding balances associated with your Mashreq bank account. This includes settling negative balances, ensuring all cheques are collected, and paying off any pending fees. Failure to resolve these dues can delay the closure process and may result in additional charges.

Transfer Funds

Before closing your account, transfer any remaining funds to another Mashreq account or an account with a different bank. This ensures that you retain access to your funds and prevents any potential complications during the closure process.

Update Automatic Transactions

Identify and update any automatic transactions linked to your Mashreq bank account, such as salary deposits or subscription payments. By updating these transactions with your new account details, you can avoid any disruptions to your finances post-closure.

Joint Accounts

If your Mashreq bank account is held jointly with another individual, it’s important to note that all account holders must be present during the closure process. Alternatively, written authorization from all account holders may be required to proceed with the closure.

Account Closure Confirmation

Obtain written confirmation of the closure of your Mashreq bank account. This confirmation serves as documentation and assures that the closure process has been completed, helping to avoid any future disputes or issues.

After Account Closure

Monitor Old Statements

Following the closure of your Mashreq bank account, it’s recommended to monitor your old bank statements for several months. This helps ensure that no unexpected debits or charges appear on your closed account, providing peace of mind and financial security.

Safe Deposit Box

If you have utilized a safe deposit box provided by Mashreq Bank, remember to collect all belongings from the box before it’s deactivated. Failure to retrieve your belongings promptly may result in loss or inconvenience.

Discard Old Debit/Credit Cards

Dispose of any old debit or credit cards associated with your closed Mashreq bank account to prevent potential misuse or unauthorized transactions. Cutting these cards ensures that they cannot be used for any financial transactions post-closure.

Alternative Methods for Account Closure

In addition to visiting a branch in person, there are alternative methods available for closing your Mashreq Bank account.

Closing Account Online

Depending on your account type and banking preferences, you may be able to initiate the closure process online through Mashreq Bank’s internet banking platform.

Sending a Written Request

If you’re unable to visit a branch or prefer not to conduct the closure process online, you can send a written request to Mashreq Bank requesting the closure of your account.

After Closing Your Account: What to Expect

Once your Mashreq Bank account has been successfully closed, there are a few final steps to take to ensure a smooth transition.

Confirmation of Closure

You’ll receive confirmation from Mashreq Bank confirming the closure of your account.

Final Statements and Documents

Keep copies of any final statements or documents related to your closed account for your records.

Ensuring No Unauthorized Transactions

Monitor your account closely following closure to ensure that no unauthorized transactions occur.

Read Also: Al Ain to Sharjah Bus: Schedule, Price, & Stops (118 Route)

Conclusion

Closing your Mashreq bank account doesn’t have to be a complicated process. By following the steps outlined in this guide and being prepared with the necessary documentation, you can smoothly navigate through the closure process with ease. Remember to clear any outstanding balances, transfer remaining funds, and return any bank-issued items to ensure a hassle-free closure experience.