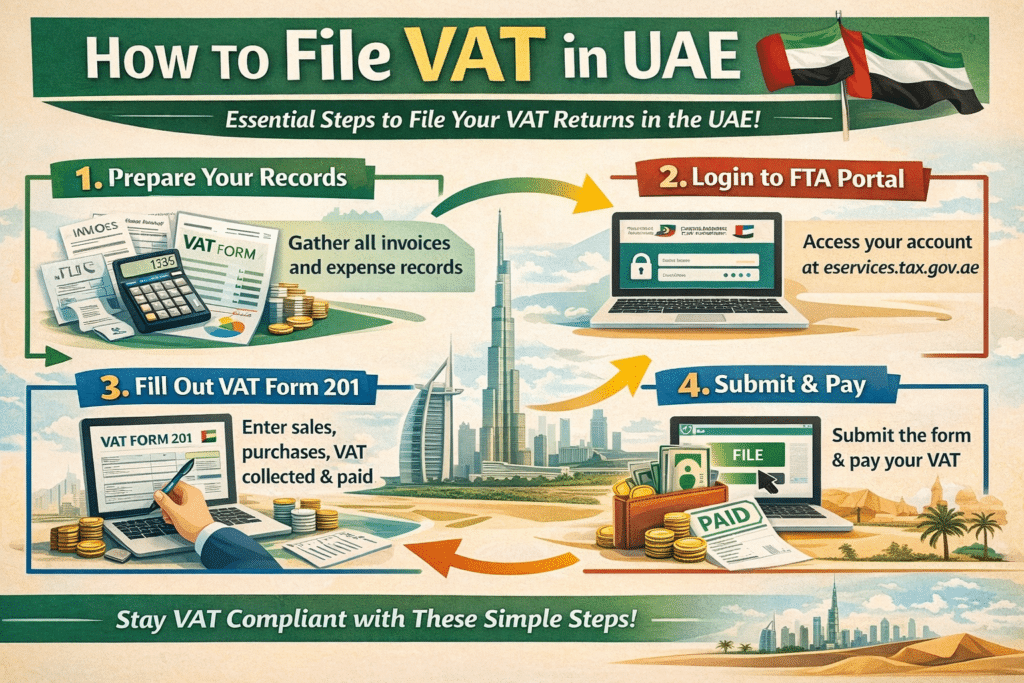

Value-added tax (VAT) is an element that is present in the tax system of the United Arab Emirates (UAE). To evade punishment, business proprietors would have to ensure proper and punctual filing of VAT returns to the government.

This guide will discuss the two major ways in which you can file VAT online in the UAE using the two main methods:

- Through the Federal Tax Authority (FTA) e-Services Portal

- Using the FTA Mobile App

Both procedures are simple to follow, and I will divide it step by step so that you, being a payer of tax, can easily complete the procedure of filling out your VAT forms.

Method 1: Through the FTA e-Services Portal

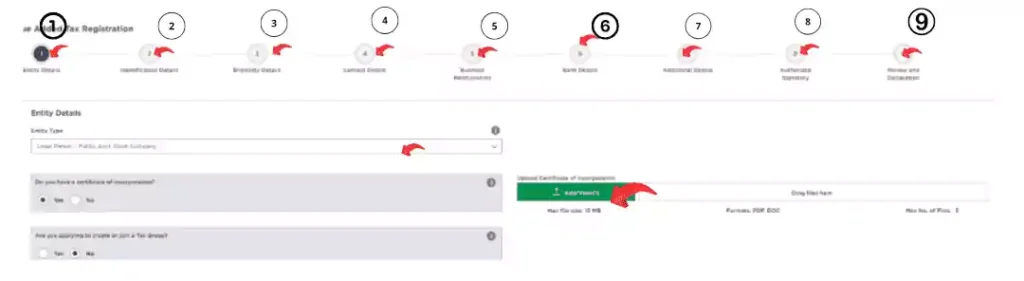

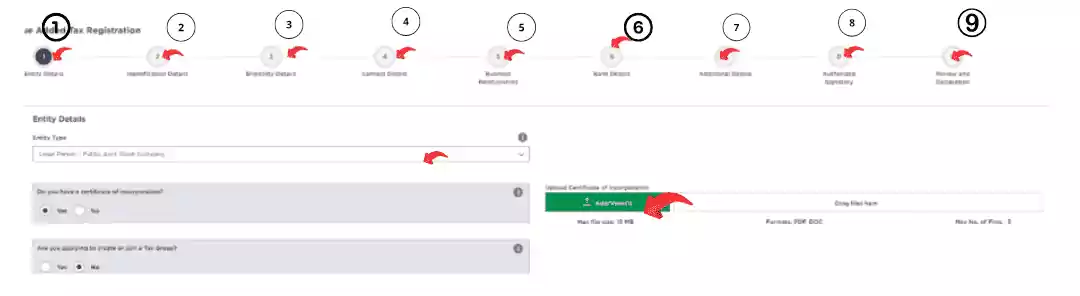

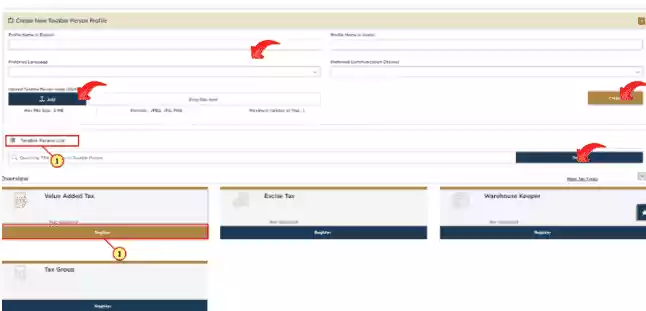

VAT is mostly filed in the UAE using the Federal Tax Authority (FTA) e-Services Portal. The proper procedure to file VAT returns entailed you to go through many steps.

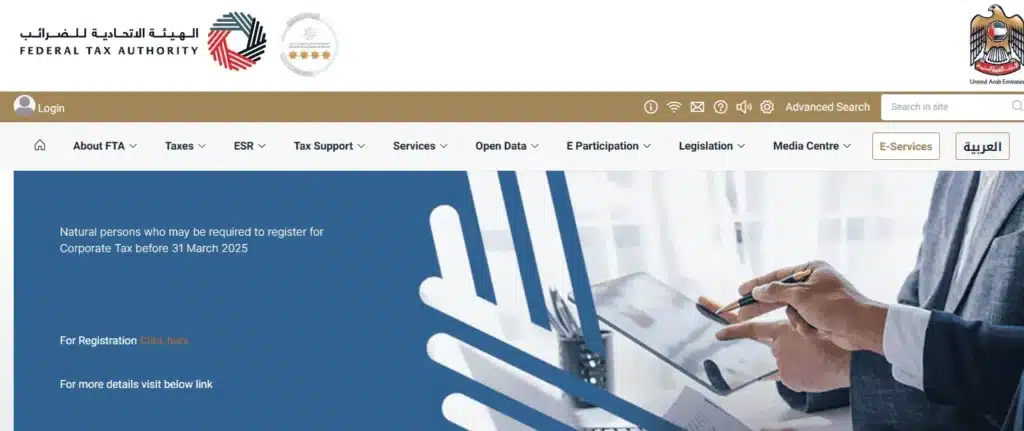

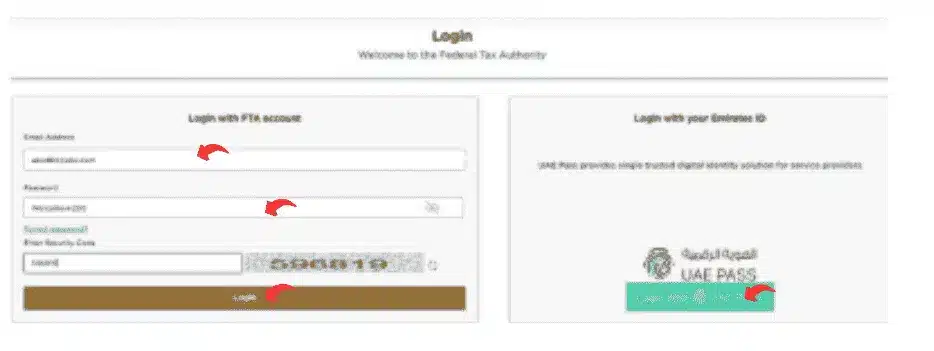

Step 1: Log in to the FTA e-Services Portal

- Visit the FTA website: https://eservices.tax.gov.ae.

- Open the login on the page and sign in with your account information.

- You will find your dashboard after clicking on the Sign in button.

Step 2: Access the VAT Return Form

- Click VAT > VAT 201 – VAT Return from the dashboard page.

- Click on New VAT Return.

Step 3: Fill in the VAT Return Form

The VAT return form divides itself into different sections for entry. The system requires you to fill in appropriate data that matches your business transactions.

- Sales and Output VAT: Enter all sales-derived VAT into the specified field.

- Purchases and Input VAT: Enter the VAT paid on business expenses.

- Net VAT Payable: Net VAT Payable stems from the system-operated calculation between Output VAT and Input VAT.

Step 4: Review and Submit

- Double-check all the details entered.

- Your VAT return data is transmitted to FTA with the Submit button.

Step 5: Pay the VAT Amount

A taxpayer who needs to pay VAT to the FTA must complete the payment before the established deadline.

- The FTA portal contains an option for My Payments that you should select.

- Choose a payment method:

- e-Dirham or credit card (instant payment).

- GIBAN bank transfer function operates through a period of up to 24 hours.

- After finishing payment, you will get an automatic confirmation.

Read Also: Urgent! Check UAE Visa Validity via ICA in 2 Minutes

Method 2: via the FTA Mobile App

Using the FTA Mobile App provides businesses with an alternative method to file their VAT returns online. The mobile application offers VAT return-filing capability to businesses.

Step 1: Download the FTA App

- Open the Google Play Store (Android) or Apple App Store (iOS).

- Users must open the Google Play Store or Apple App Store to download the Federal Tax Authority (FTA) App through the search term “FTA UAE”.

Step 2: Log in to Your Account

- Users must start by opening the FTA app and inputting the registered email and password.

- Follow the instructions to authenticate your identity by using the OTP system if the app requires it.

Step 3: Go to the VAT Filing Section

- On the app’s home screen, tap “VAT”.

- Select “File VAT Return”.

- Select the tax period you want to file through the application.

Step 4: Enter VAT Details

The application follows exactly the same procedure as the website for entering:

- Sales and Output VAT (VAT collected from customers).

- Purchases and Input VAT (VAT paid on business expenses).

- Net VAT Payable or Refundable (automatically calculated).

Step 5: Submit VAT Return

- Review all entered details carefully.

- Tap “Submit VAT Return”.

- Your request will go through the processing system.

Step 6: Pay VAT Amount (if applicable)

A payment needs to be completed when VAT tax debt exists to the FTA.

- You can utilize the payment function in the app to execute payments through e-Dirham or bank transfer or credit card methods.

- e-Dirham

- Credit card

- Bank transfer

Step 7: Download Confirmation

- Users must access the confirmation receipt by downloading it from the app after the successful submission of their VAT return.

Why Is It Important to File VAT on Time?

The Federal Tax Authority will assess penalties against you if your VAT return submission passes the deadline. Time-sensitive VAT submission has three essential benefits:

- Avoiding fines and penalties: Late VAT filing will lead to financial penalties, which reach maximum levels of AED 10,000.

- Ensuring business compliance: Businesses staying compliant depends on their correct VAT reporting practices.

- Maintaining a good tax record: A clean tax documentation supports a business’s market credibility.

Common Mistakes to Avoid When Filing VAT Online

There are two main steps to filing VAT online, but businesses should stay alert to avoid three particular errors:

- Incorrect VAT calculations: Businesses should confirm the correctness of their VAT calculations by verifying both input and output amounts. You can use our VAT Calculator for this easily.

- Missed deadlines: The submission of your VAT return must occur before the deadline since failure leads to financial penalties.

- Wrong tax period selection: Choose the correct tax period from the available options during your online VAT filing process.

- Not keeping records: Always keep a copy of your VAT file and payment confirmation for future reference.

Read Also: Dubai Jaywalking Fine: Avoid the AED 400 Penalty Now!

Final Words

Online VAT submission in the UAE remains easy to accomplish when users abide by proper procedures. The FTA e-Services Portal as well as the FTA Mobile App, provide users with easy methods to file their VAT. Check for correct information entry, then inspect all data before submission, while processing payment when required.

The guide provides all necessary steps to ensure your VAT filing will be accurate and timely in UAE regulatory compliance. VAT return filing requires expert consultation for anyone who feels unsure because mistakes in reporting may occur.