First Abu Dhabi Bank (FAB) is one of the most recognized and influential financial companies in the UAE that provides different types of banking services that may be interesting for both UAE residents and foreigners. One of the services provided by the bank and listed below is the FAB iSave account savings which is a savings account available in FAB. FAB presently has a savings account known as the FAB iSave account that is an ideal product whenever you are trying to save your money towards future expenses or simply need a safe place to keep your savings.

In this guide, I will offer you the step-by-step details of how to open an FAB iSave account by using the various channels, and things to consider so that you do not end up with unnecessary details in the account.

What is the FAB iSave Account?

The FAB iSave account is an interest-bearing savings account offered by the First Abu Dhabi Bank. This type enables you to deposit and even earn interest on your cash while providing the option of withdrawing your money at any time. It is for those who want to conserve more of their money through high-interest rates and is conveniently available through a digital device.

How to Open an FAB iSave Account?

There are two primary methods to open a FAB iSave account:

- Through FAB Online Banking

- Through the FAB Mobile App

We’ll guide you through both methods step-by-step.

Method 1: Open a FAB iSave Account through Online Banking

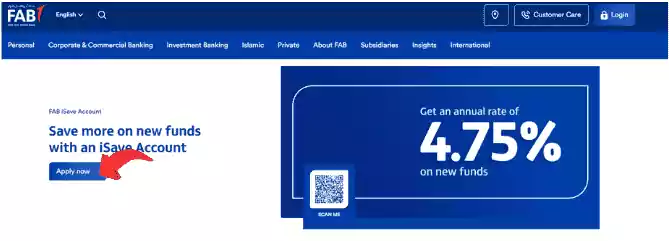

- Go to the FAB website: https://www.bankfab.com

If you are already an FAB customer and have access to FAB’s online banking platform, opening an iSave account is a simple process. Follow the steps below to get started.

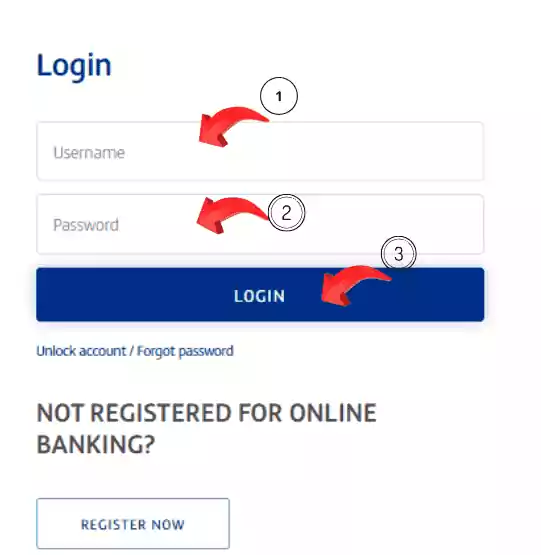

Step 1: Log in to Your FAB Online Banking Account

Go to the official FAB website and enter your online banking account details to log into your account.

Step 2: Navigate to the “Accounts” Section

After accessing the home page of the platform, scroll to the left-hand side menu and click on the “Accounts” tab.

Step 3: Select the “iSave Account” Option

Look for the option to open a new account and select “iSave Account” from the list of available account types.

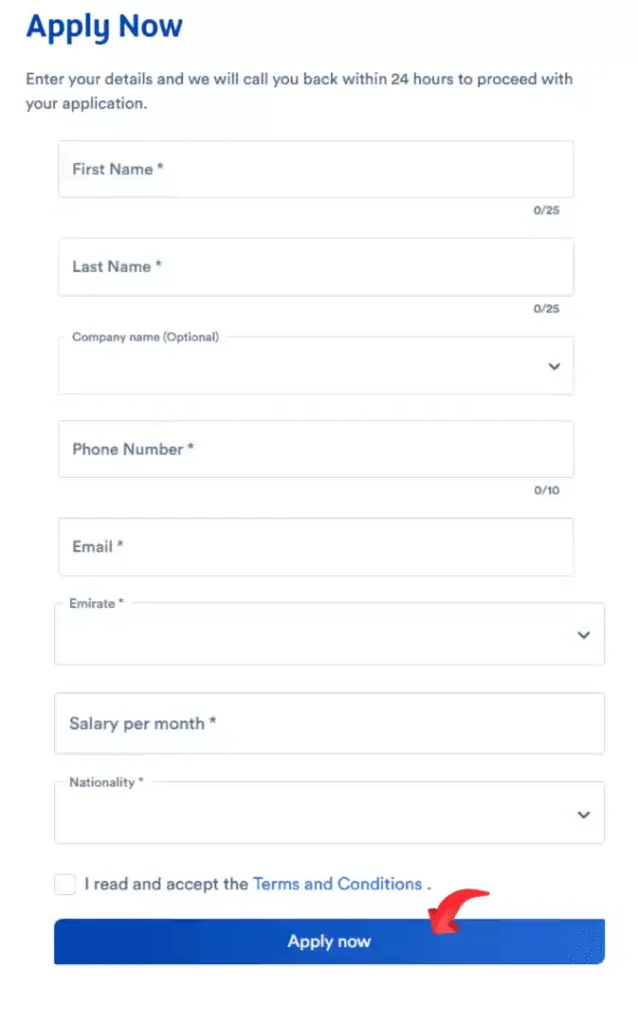

Step 4: Complete the Online Application Form

You will be directed to an application form. Ensure that you complete all the fields that pertain to the person, as well as the fields that pertain to the financial aspect.

Step 5: Submit the Application and Upload Documents

You may also be asked to scan and attach documents to support some of the details in the form after you have filled it. These often include Emirates ID, passport, and proof of income like a salary statement or income certificate.

Step 6: Review and Confirm

Carefully review all the information you have entered. It is essential to ensure that all details are accurate, as any errors could delay your application. Additionally, review the terms and conditions associated with the iSave account.

Step 7: Account Activation

After you complete and submit the application, FAB will review your request. At the successful completion of the iSave registration process, you will be informed of approval and account activation shortly. You can then begin to operate the new savings account through FAB Online Banking.

Method 2: Open a FAB iSave Account through the FAB Mobile App

Through FAB’s Mobile App, you can conveniently complete all your banking requirements, including signing up for an iSave account. And so here is how it may be done.

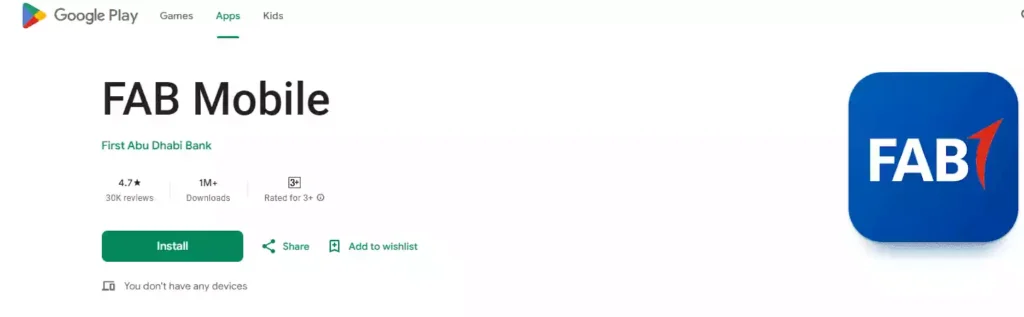

Step 1: Download the FAB Mobile App

If you do not have it already, please download the FAB Mobile App through the Apple Store for Apple devices or Google Play Store for Android devices.

Step 2: Log in to Your FAB Mobile Banking Account

Open the app and log in with your FAB Mobile Banking credentials. Ensure that you have an existing FAB account before proceeding.

Step 3: Navigate to the “Accounts” or “Savings” Section

After you have signed in to the app, you will need to navigate to the“Accounts” or “Savings” tab. It is here that you can choose how to open a new savings account.

Step 4: Select “Open iSave Account”

With the layout of the app, select an option that has something equivalent to the following: ” open iSave Account.”

Step 5: Fill in the Required Details

Include all the necessary personal and monetary information in the application form. Ensure that the information you send is correct to prevent any hiccups in the process of approval.

Step 6: Submit the Application

Send the application form after completing all the information required. You will be asked to send the appropriate documents to prove your application, and this could be your Emirates ID, passport, and evidence of income. This step will simply require you to observe a row of prompts, which will be displayed on the screen.

Step 7: Account Activation

Once you complete the application process, FAB will review it, and you will receive a notification when your iSave account is ready. You can also log in to the FAB Mobile App and be able to begin savings account management.

Eligibility Criteria

To open a FAB iSave account, you must meet certain eligibility criteria:

- Existing FAB Account: The only way to open an iSave account is if you are already a holder of an FAB account. And if you are using eBanking you have to open an account first before applying for the iSave account.

- Emirates ID: A valid Emirates ID is required for all account holders. This is a mandatory identification document for residents of the UAE.

- Proof of Income: Depending on the company’s requirements, you may be required to present documents that prove your income, for instance, a pay cheque or an income statement.

Documents Required

It was also indicated that such problems could be prevented by ensuring that applicants are equipped with all required documents before applying to avert the eventualities.

- Emirates ID: A copy of your genuine Emirates ID.

- Passport: Photo of your passport (in the case of expatriates).

- Resident Visa: You must submit a copy of your valid resident visa (the case of expatriates).

- Proof of Income: Salary slip or income certificate.

Ensure that the required papers are in place as well and clean photocopies are offered wherever necessary.

Read Also: Dubai Business Setup: A Step-by-Step Guide

Final Words

To open an FAB iSave account, one simply needs to access the FAB Online Banking or the FAB Mobile App. The iSave account does not have minimum balance restrictions, pays decent interest on balances, and is available both online and via a mobile app.

With the information given in this guide and other significant factors, such as eligibility and requirements for account opening, in mind, one can open the FAB iSave account and begin to reap the benefits.