You can easily open a zero-balance account provided by Al Hilal Bank in the UAE through channels that suit your preference. Al Hilal Bank offers digital and traditional channels at your disposal to start an account promptly, no matter if you work with a salary or need basic banking without maintenance requirements.

This extensive guide provides instructions on opening a zero-balance account at Al Hilal Bank through various methods.

- Online through the website

- Using the mobile app

- Contact center

- Visiting a branch in person

The guide offers systematic instructions for each method to help you select the appropriate route that fits your conditions.

What Is a Zero Balance Account at Al Hilal Bank

Zero balance accounts operate as financial instruments which eliminate the need for deposit requirements. Such banking accounts work perfectly for those who receive salaries and students in addition to people who value simple banking services. The subsidiary Al Hilal Bank under ADCB (Abu Dhabi Commercial Bank) provides Shariah-compliant banking services through its advanced digital infrastructure while offering excellent customer support.

How to Open an Al Hilal Bank Account

Employees at Al Hilal Bank may open zero-balance accounts through their official website from any computer system without requiring a physical branch visit. Just follow these steps.

Step-by-Step Guide to Opening an Account via the Website

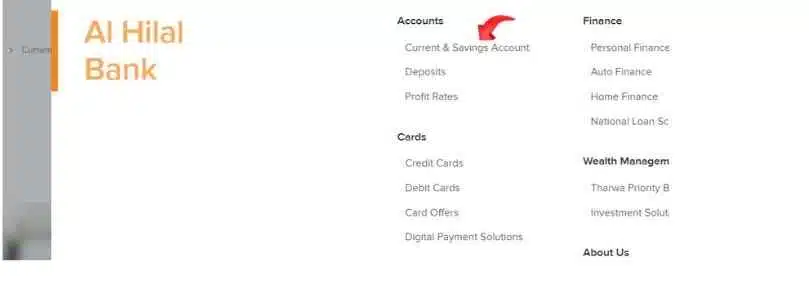

Step 1: Visit the Official Website

Go to Al hilal Bank website: https://www.alhilalbank.ae/en/ways-to-bank/mobile-banking

Step 2: Click on “Open Account” or “Apply Now”

- Users should select the “Open Account” button based on the website.

- Click on it to start your journey.

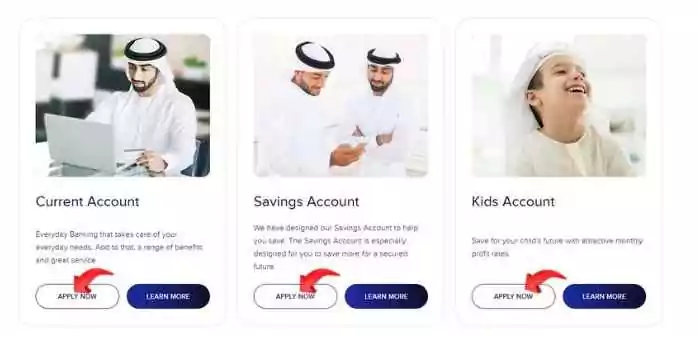

Step 3: Choose the Type of Account

- Select either:

- Current Account

- Digital Salary Account

Step 4: Fill Out the Online Form

This is where you will enter some basic information:

- Full Name

- Mobile Number

- Email ID

- Emirates ID Number

- Location (City/Emirate)

Make sure you enter everything correctly. The bank will contact you using this information.

Step 5: Upload Required Documents

The required documents for uploading include both front and back sides of your Emirates ID and any requested photograph or scan of your passport.

- Emirates ID (front and back)

- Passport (if requested)

Keep them clear and legible. Any documents that contain poor image quality may result in application processing delays.

Step 6: Submit the Application

Press Submit after you fill in all information with uploaded files.

Step 7: Wait for a Call or Email

After submission:

- Al Hilal Bank will get in touch via phone or email within a two-day working period.

- They may schedule a KYC verification call.

- Requests for physical meetings happen almost never due to the unusual nature of such requests.

Step 8: Account Approval and Activation

Once approved:

- You will receive your account number.

- Your debit card will be delivered to your registered address through the delivery service.

Read Also: How to File VAT in UAE – Quick Guide to Avoid Fines

Open an Al Hilal Bank Account Through the Mobile App

Opening the account with only your smartphone makes this method the best choice.

Step-by-Step Guide Using Al Hilal Mobile Banking App

Step 1: Download the Al Hilal Mobile App

- For iPhone users: Go to the App Store

- For Android users: Go to the Google Play Store

The app for Al Hilal Mobile Banking can be found in the App Store and Google Play Store under the search term.

Step 2: Launch the App and Select “Open New Account”

- Open the app after installation.

- Open a New Account appears as one of the options on the home screen.

Step 3: Enter Basic Personal Details

Provide these information points accurately to finish:

- Full Name

- Mobile Number

- Address

- Employment Status

- Nationality

- Emirates ID Number

Step 4: Choose the Type of Zero Balance Account

Now, select the account type:

- Digital Current Account

- Digital Salary Account

Both options are zero balance eligible.

Step 5: Verify Your Mobile Number

- An OTP (One-Time Password) delivery service will reach your UAE mobile number which you have registered.

- Enter the OTP to proceed.

Step 6: Upload Necessary Documents

Just like the website method:

- Upload scanned copies of Emirates ID

- Upload Passport (if required)

Step 7: Submit and Wait for Verification

Your request finishes the process after which you might face a video interview or phone authentication procedure.

Step 8: Account Activation

The bank will authorize your application subsequent to its approval.

- You get instant access to mobile banking.

- Debit card will be delivered to you.

3. Contact Al Hilal Bank’s 24/7 Customer Center

Get in touch with their customer center through any means that suits you best in case you have issues with your application.

Contact Details

Call: 600 522 229 (UAE-wide)

- Available 24 hours, 7 days a week

- Friendly and professional support team

- Ask for help regarding:

- Opening a zero balance account

- Application status

- Document requirements

- Debit card delivery

Customer service representatives along with the team members provide assistance from every usage phase to solve your encountered problems.

Visit a Physical Al Hilal Branch

Visiting banks physically remains a preference among particular individuals.

Steps to Open an Account at a Branch

- You must locate the closest Al Hilal Bank branch inside your emirate.

- Bring the required documents:

- Emirates ID

- Passport

- A salary certificate serves as an optional document when requestors ask for it.

- You should talk to the relationship manager who operates at the counter area.

- Finish your application for new account through the required form.

- Enter your mobile contact information and email address.

- The staff may need you to provide a biometric verification.

Common Questions About Opening a Zero-Balance Account

Is there any salary requirement for a zero balance account?

There exists no minimum salary requirement. Specific income verification might be needed if you select a Salary Account.

Can non-residents open this account?

No. UAE residents who hold valid Emirates ID are the only ones who can create zero balance accounts with Al Hilal Bank.

Are there any hidden fees?

No. When you select a correct zero balance product it will free you from paying any hidden maintenance costs.

How long does it take to open the account?

The process takes 1 to 2 working days when customers apply through digital channels. Digital applications for in-branch take 1 to 2 working days but verification time at branches can vary the processing speed.

Read Also: 10 Best UAE Job Sites to Get Hired Fast (Apply Now!)

Final Thoughts

The zero balance account at Al Hilal Bank provides UAE customers with a dependable electronic banking system without any costs. Customers can open their account through website access and mobile application usage in addition to support from the contact center personnel and personal visit.

I find that Al Hilal Bank provides a dependable package of digital services and friendly support to people who need basic personal banking without balance requirements.