Are you confused about what a RIM number is and why it’s so important? Then, you are not alone. However, a lot of individuals do not even suspect what it is and where to find it. Whether you’re setting up a business, hiring employees, or handling legal documents, this one number can make or break your official processes.

Relationship Identification Number (Rim number) is becoming an increasingly popular option when it comes to the secure development of digital identities in the banking, telecommunications and others.

In this complete guide, we’ll walk you through everything you need to know how to know the RIM number, locating the RIM number and where it is used, as well as its impact on your work permits, labour contracts and company profile within Dubai.

What is the RIM Number

Relationship Identification Number (RIM Number) is used to identify individuals and organizations with unique numbers to better identify people and organizations across sectors. Mostly applicable in banking and telecommunication sector, a RIM Number operates as a digital finger print, enabling a financial institution to authenticate identities and facilitate the process of security provisions in financial dealings.

Key Applications of RIM Numbers

- Identifying a Customer: The RIM number is another set of number which is added to the customer name so that the bank is able to distinguish between the various customers especially in the situation

- Linking Accounts: A RIM number is a universal account identification number that combines some accounts of a customer like checking, saving, credit, etc.

- Processing Transactions: The customer may use RIM number to authenticate his/her identity in order to introduce business transactions.

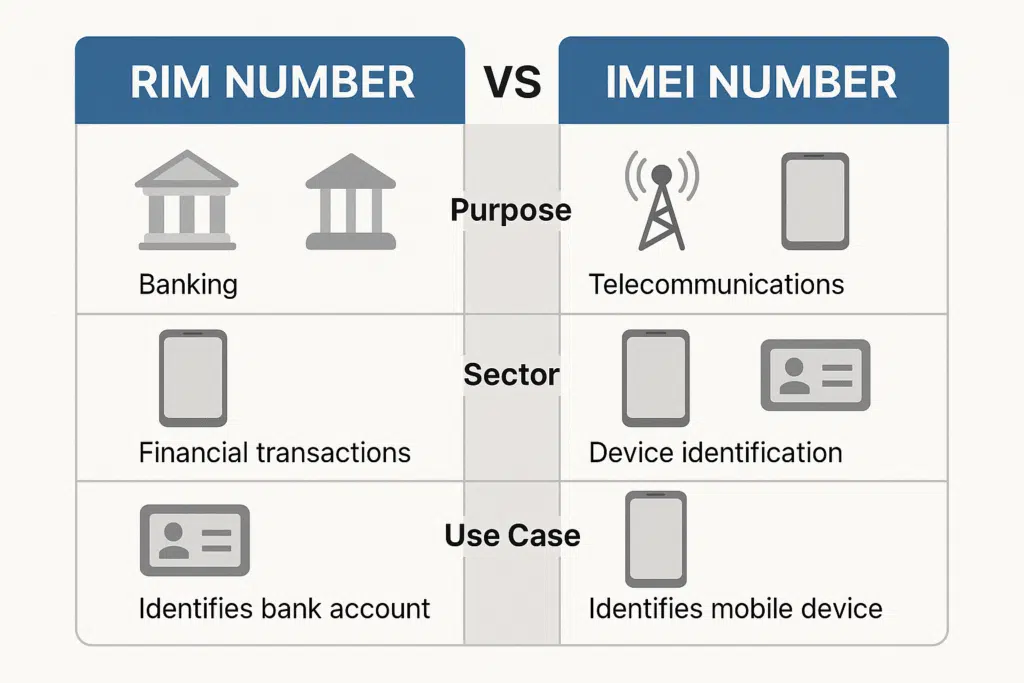

Differences between RIM Numbers and IMEI Numbers

International Mobile Equipment Identity (IMEI) numbers and RIM Numbers exhibit a similar characteristic of becoming unique identifiers, there is a big difference regarding their functionality and scope.

| Attribute | RIM Number | IMEI Number |

|---|---|---|

| Purpose | Identification in banking and compliance | Device authentication and tracking |

| Primary Sector | Financial, telecommunications | Telecommunications |

| Functionality | Customer identity and transaction tracking | Device security and network access |

| Use Case | Multi-account linking, regulatory compliance | Theft protection, network management |

The financial and regulatory transactions mostly use the RIM Numbers to lock the data of the users, whereas the IMEI Numbers can be used to track them and identify the network. Studying these differences enables institutions to choose the right solution regarding the special identification needs.

What is Rim Number in Banking ADIB

Abu Dhabi Islamic Bank (ADIB) is one of the companies that uses RIM Numbers to manage operations and enhance security. ADIB can assign every customer the unique RIM Number to simplify the account management process, make the safe financial transaction, and comply with the regulations of the central banking.

Benefits of RIM Numbers for ADIB Clients

- Secure Transactions: RIM Numbers allow taking of further verification procedures lowering fraud cases.

- Streamlined Account Management: ADIB clients find numerous accounts accessible via a single RIM Number, therefore, the account handling gets simpler.

- Enhanced Compliance: ADIB will achieve improved compliance levels as the RIM Numbers will bring the bank to the standard levels that it is supposed to, in terms of protecting client assets

How RIM Numbers are Assigned in Banking and Technology

- Assignment in Banking: Banks typically generate RIM Numbers upon account creation. These numbers link all customer accounts to a unique identifier.

- Assignment in Mobile Technology: Manufacturers assign RIM Numbers at the device production stage to certify that each device meets regulatory standards, preventing unauthorized distribution. This practice also enhances device security and tracking capabilities, such as anti-theft measures.

RIM Number in Mobile Security: Tracking, Security, and Warranty

- Warranty and Service: RIM Numbers can be used by service centers to verify devices and keep counterfeit devices out of service, so only authentic devices may be authorized to receive repairs or service.

- Device Tracking: Unique RIM Number is assigned to each device, and it allows device manufacturers and service providers to trace activities, handle security risks and remotely erase or lock their devices in case of loss or even theft.

Read Also: How to Pay Overstay Fine in UAE Online.

How to Locate Your RIM Number on Devices

In case of diverse appliances, the finding of RIM Number is different:

- On the Device: The RIM Number will be on the label of the manufacturer which is normally at the back of the device or the underside of the battery.

- Via Device Settings: RIM Number in Settings in most smart phones, under device information. The dialing code may also be user controlled enabling users to dial a code that displays the RIM Number on screen.

- Using Documentation: The user manual or the manufacturer site can supply in many cases extensive guidance on where to find the RIM Number, based on the type of device to be used.

Importance of RIM Number Security

It is also important to keep your RIM Number safe. Here’s why:

- Fraud Prevention: RIM Numbers are associated identity and financial information; if accessed without authorisation, it can result to identity theft or loss of funds.

- Device Recovery: Stored RIM Number means a quick and easy recover process and insurance claims in case of loss of device.

- Streamlined Warranty and Service: Within service claims, RIM Number helps manufacturers to legitimize the claims they receive and reduce fraud licenses.

RIM Numbers of their purchases with their store purchases and model information in a secure place so that it could be easily retrieved in case it is required.

How to Obtain an RIM Number from ADIB Bank

Through opening an account with the bank, the customers will be issued with a special Rendit Bank Number to access various banking services both online and offline environments.

How ADIB Bank Utilizes RIM Numbers

ADIB Bank (AB) constructs RIM Numbers in its structure of operation as its devotement to the standholder compliance and the transparency. With the help of the RIM Numbers, ADIB acquires security of central bank regulations and clients as establishing a comfortable banking environment.

Method 1: Check Your Bank Statement

To get your RIM number you can look at your bank statement and find it on it. Among your account details you should have your RIM number.

Steps

- Access your bank statement: Go online or off and have fact-finding missions by reading your statement whether it is a paper or online statement.

- Look for account details: Search by stopping at the page where you locate the heading “Account Details” or its similar title. You should also keep your RIM number and account details recorded there.

- Note down the RIM number: Always write down exactly the RIM number that you observe on your statement; this will come in handy in the future.

Method 2: Contact ADIB Customer Service

Even in the occasion that you do not scan where RIM number for your current account has posted, do not fret, simply call our customer services department.

Steps

- Find the customer service number: Use your debit card and type the customer care phone number of ADB in the back of your card or consult the site of the bank.

- Call customer service: Make a phone call and speak to an attendant. Tell them that you need help in RIM number look-up after which you will be facilitated in the process.

- Provide necessary information: In order to prevent the hassles of the identity verification you might need to provide some of the personal information

Method 3: Visit an ADIB Branch

Free to visit any of the close ADIB branches and talk to the banking staff members directly about your banking related issues. They will assist you in accessing your RIM number and after that, be good enough to take care of all the chances you will come across.

Steps:

- Locate a branch: Find the address of the closest branch with the help of the bank web site or any other source like phone directory.

- Visit the branch: Visit the branch at regular working time with matching an id card in case of need of the same.

- Speak with a representative: ATell the customer service officer to help you with the procedure of finding out your RIM number.

Frequently Asked Questions (FAQs)

What is a RIM Number?

A RIM (Relationship Identification Number) is a special number through which a bank can identify customers; e.g. ADIB. It manages your various accounts and guarantees a safe-banking and anti-fraud process.

Where Can I Find My RIM Number?

You are able to locate your RIM number:

- On your bank statement

- By calling ADIB customer service

- By visiting any ADIB branch

Is RIM the Same as IMEI?

No.

- RIM: RIM is an identification of people through banking.

- IMEI: Used to identify and track devices in telecom.

Both are unique but serve different purposes.

Can I Get a RIM Number Without a Bank Account?

No. You must open an account with a bank like ADIB to receive a RIM Number.

Why Is the RIM Number Important?

It allows:

- Faster banking

- Secure transactions

- Regulatory compliance

Essential for business setup, work permits, and identity verification.

Is It Safe to Share My RIM Number?

No. You Need to Open A Bank Account With A Bank such As ADIB In Order to Receive a RIM Number.

Also Read: Top List Of Logistics Companies In Dubai.

Final Words

RIM numbers improve online security and ease the authentication process in the banking industry and the phone industry. They are important in providing financial transaction security, protecting personal information and also helping to ensure that the regulations are adhered to. RIM Numbers represent a feasible method of protecting digital identities and assets whether they are combined with bank services such as with ADIB or with smart phones.

You must remember to protect your RIM Number, which is a key to security and compliance as well as a smooth experience of using digital platforms.