The C3 Pay mobile app provides simple and convenient capabilities to move funds from your C3 card to UAE bank accounts. This step-by-step tutorial provides instructions to both C3 card salary recipients and regular users on how they can complete their hassle-free fund transfer to UAE bank accounts.

In this guide, I will covers everything you need to know—from downloading the app to verifying your identity and successfully transferring funds to your preferred UAE bank account.

What Is a C3 Card

The C3 card represents a prepaid payroll card available within UAE workplaces to handle employee salary distributions, mainly among private sector personnel and employees from labor-based industries. Employers at Edenred can transfer employee salaries to their C3 card account through this payment method. Workers in the UAE use the C3 card for secure salary deposits which meet all local Wages Protection System requirements.

Step-by-Step Guide to Transfer Money via the C3 App

Step 1: Download the C3 Mobile App

The C3 Pay App functions as the official platform for C3 card administration and service management therefore you need access to download it to initiate transfers.

Where to Download:

- Android Users: Visit the Google Play Store and search for “C3 Pay”.

- iPhone Users: Visit the Apple App Store and search for “C3 Pay”.

Step 2: Register or Log In to Your Account

Once the app is installed:

- Open the app.

- If you’re a first-time user, tap on ‘Register’.

- Use the mobile number that you have associated with your C3 card to continue.

- For verification you must input the One Time Password which the system sends to your phone.

- Set a secure password.

Proceed with logging into your account by using your existing credentials when you have already gone through the registration process.

Step 3: Add a Beneficiary (UAE Bank Account)

You must select a beneficiary until you choose their bank account for money transfer.

Steps to Add a Beneficiary

To send money, you need to add a beneficiary, i.e., the bank account where the money will be transferred.

Steps to Add a Beneficiary

- Tap on ‘Send Money’ from the main dashboard.

- Go ‘To Bank Account in UAE’.

- Tap ‘Add New Beneficiary’.

- Fill in the following details:

- Beneficiary’s Full Name (as per bank records)

- Bank Name

- IBAN Number (International Bank Account Number)

- Mobile Number (optional)

- Verify every detail to confirm the correctness of information.

- Tap ‘Save’.

After saving, the added beneficiary will remain available for future money transfers.

Step 5: Initiate the Transfer

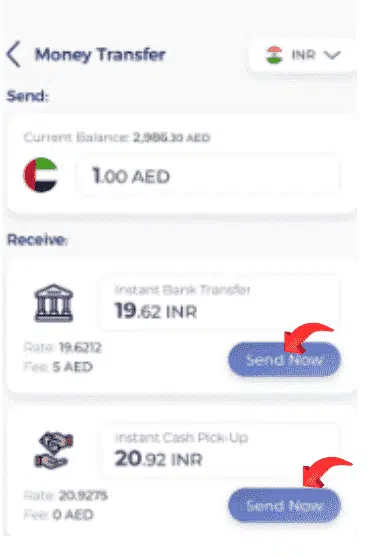

The system lets you start the money transfer process after successfully adding a beneficiary to your account.

Follow these Steps

- Tap on ‘Send Money’.

- Select the United Arab Emirates bank account from those you earlier added.

- Enter the amount you wish to transfer.

- Check both the transfer fee costs and the complete amount of the transaction.

- Confirm the details and tap ‘Send’.

The registered mobile number will get an OTP message for completing the confirmation process. The system will process the entered transaction.

Step 6: Confirmation and Receipt

A confirmation notification about your transaction will arrive in the application together with a corresponding SMS or email (if available). You have the ability to save your transaction receipt through downloading or taking a screenshot.

Read Also: How to Open a UAE Bank Account as a Non-Resident (2025)

Key Things to Know Before You Transfer

Transfer Limits

- Cardholders of C3 need to follow daily/montly transfer restrictions that vary according to their KYC verification level.

- The transfer limits of users with full verification status are generally higher compared to those without full verification.

- Users can view limits through the ‘Account Info’ page inside the app.

Transfer Fees

- C3 implements minimal charges for each local bank transfer service that occurs through the platform.

- The fee amount depends on transaction value combined with the chosen bank for receipt.

- Before proceeding with payment you will see the precise transfer fee displayed.

Transfer Time

- UAE bank transfers executed within the banking district operate at a completion time of 24 hours.

- Other banking days including weekends will extend the usual processing time for transactions.

- Some banks may reflect the transaction faster than others.

Additional Features of the C3 Pay App

The C3 Pay app functions as more than an application for transferring money between individuals. Users have access to different practical features through this application.

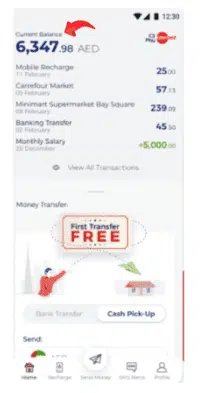

Check Your Balance

View your current card balance through the home screen any time you need.

Mobile Recharge

You can easily add balance to your UAE mobile phone number or any international cell phone from your C3 payment card.

International Transfers

Users can utilize integrated global remittance partners on the app to transfer money across countries that include India, Philippines, Pakistan, Nepal and others.

Bill Payments

Users can use the app for immediate bill payments on Etisalat and DU services and DEWA and SEWA utilities without waiting in queues.

Transaction History

View a detailed history of all your transactions, which helps with budgeting and financial planning.

Common Issues and Troubleshooting

1. Transfer Failed or Rejected

If your transfer fails:

- Recheck the IBAN number and bank name

- Ensure you have sufficient balance

- Confirm that your account is verified

In case issues persist users need to reach out to C3 support by using their app or making a call to their helpline.

2. Delay in Credit to Bank Account

All transactions usually complete instantly but occasionally take between a few hours to reach a maximum duration of 24 hours. The transfer process requires more than one day for completion.

- Contact your bank to check on the incoming transaction

- Contact C3 customer support for transaction details

3. Unable to Add Beneficiary

Make sure:

- The IBAN is valid and active

- Your mobile app is updated

- You’ve completed your KYC process

Tips for Secure Transfers

- You need to verify beneficiary information precisely before executing a transaction.

- Keep your app updated to access the latest features and security patches.

- Avoiding public Wi-Fi networks when you need to make transactions is essential.

- Both your passwords must be robust, while you should never provide your login account particulars to anyone.

- Enable notifications for every transaction for real-time alerts.

C3 Customer Support Contact Details

C3 provides customers with superior assistance through different channels when they encounter any issues.

- In-App Chat: Available inside the app for quick help.

- Toll-Free Number: 800 C3PAY (23729)

- Email: support@edenred.ae

- Website: https://www.c3bank.com/

Read Also: Urgent: Emirates ID Status Check Before Your 2025 Return

Final Thoughts

The C3 Pay App permits users to conduct fast secure banking transactions that move C3 card funds to UAE bank accounts. The C3 Pay App allows you to shift your funds instantly into your personal bank account to gain better payment and savings options. Using C3 Pay lets users access an interface which is dependable and swift and meets all UAE financial regulations regarding compliance.

The information in this guide provides complete knowledge to all users who either receive their wages through C3 cards or handle various income streams so they can execute hassle-free transactions.