VAT is an essential factor for businesses operating within the UAE. Every business owner operating in the UAE must register for VAT with the Federal Tax Authority (FTA) when their operations reach the VAT threshold requirements.

In this guide, I will walk you through the VAT registration process step by step, ensuring you understand every detail.

Methods to Register for VAT in the UAE

There are three main ways to register for VAT in the UAE:

- Online VAT Registration via the FTA Portal (Best for self-registration)

- Registering via a Tax Consultant (Best for expert assistance)

- Registering Through a Free Zone Authority (Best for free zone businesses)

Let’s go through each method in detail.

Method 1: Online VAT Registration via the FTA Portal

Step 1: Create an FTA e-Services Account

- Visit the Federal Tax Authority (FTA) website.

- Visitors should first move to the “e-Services” page before picking “Sign up”.

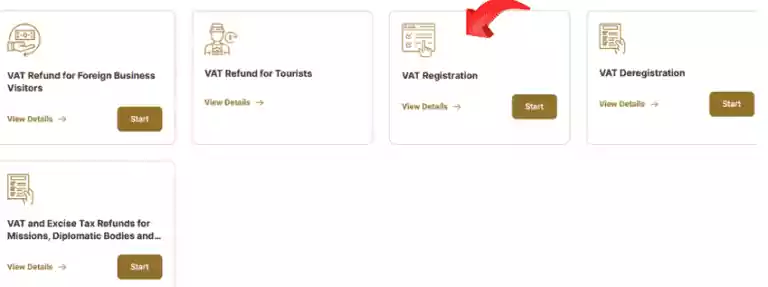

Step 2: Log in to the FTA Portal

- Enter your login information at the FTA portal website.

- The first step to apply begins with selecting “Register for VAT” from the website.

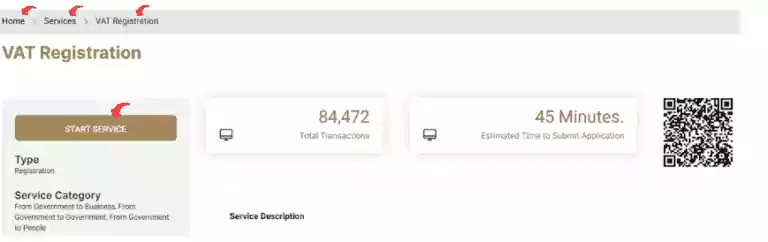

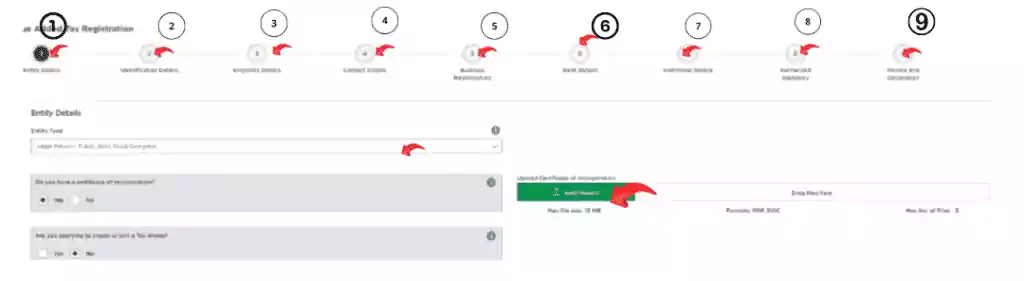

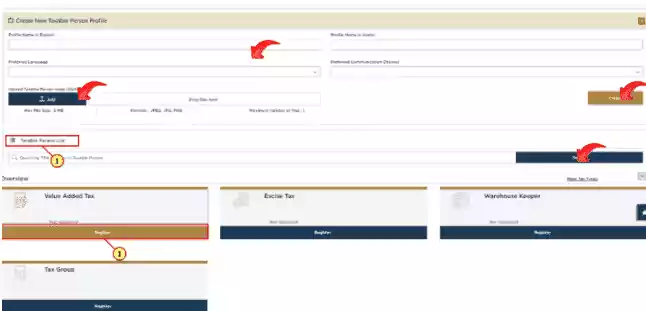

Step 3: Fill in the VAT Registration Form

The registration form for VAT uses various key segment divisions.

1. Applicant Details

- The business application requires the submission of your business name and the trade license number while specifying the organization’s legal structure.

2. Business Information

- State your business category as well as your main operations and the ownership relationships that exist.

3. Contact Details

- Enter your business address, phone number, and email information into the system.

4. Bank Account Details

- Provide your IBAN and bank details Submit your bank account IBAN along with its specifications to receive tax refund payments.

5. VAT Registration Information

- State your business turnover subject to tax together with your estimated income levels.

6. Declaration and Authorization

- Sign the terms and conditions agreement after reviewing them.

Step 4: Upload Required Documents

Your application requires the submission of needed documents, which must be presented in either PDF or JPG file type.

- Trade license copy

- Passport and Emirates ID of the owner(s)

- Proof of business turnover (e.g., audited financial statements, invoices)

- Bank account details

- Customs registration certificate (if applicable)

Step 5: Submit the Application

- To finish your form, simply click “Submit”.

- Your FTA application review process requires potential extra documents for review.

Step 6: Receive Your VAT Registration Certificate

- The receipt of your Tax Registration Number (TRN) will arrive through your registered email address.

- You can obtain the VAT certificate through your FTA account.

Read Also: Book COVID-19 Vaccine Appointment in Dubai – Fast & Easy!

Method 2: Registering via a Tax Consultant

Expert consultants who are licensed in tax matters will register your business for VAT when you hire them to provide this service.

Steps to Register via a Tax Consultant

- Find a licensed tax consultant in the UAE.

- You should identify and work with a UAE-licensed tax consultant.

- Supply your business information together with documents to the consultant.

- They will submit your application and follow up with the FTA.

- The FTA application will be submitted by them, and they will maintain communication with the FTA authorities.

Benefits of Hiring a Tax Consultant

- ✔ Saves time and reduces errors.

- ✔ Ensures compliance with UAE tax laws.

- ✔ Expert guidance on VAT regulations.

- ✔ Assistance with VAT filing and refunds.

Method 3: Registering Through a Free Zone Authority

Free zone authorities in UAE provide supportive services to businesses for obtaining VAT registration.

Steps to Register via a Free Zone Authority

- Contact the authorities of your free zone to determine if they assist VAT registration functions.

- Enter your business files into the free zone authority system.

- Through this service, the free zone authority completes your application submission to the FTA for processing.

- The FTA will approve your application, and you will obtain your TRN while also receiving the VAT certificate.

Why Register Through a Free Zone Authority?

- Simplified process for businesses operating in free zones.

- Compliance support for special VAT regulations in free zones.

- Seamless registration and guidance.

Who Needs to Register for VAT in the UAE?

Before registering, determine if your business meets the following criteria:

- Mandatory Registration: Your business should register for VAT when your annual taxable supplies and imports surpass the threshold of AED 375,000.

- Voluntary Registration: A business that has taxable supplies or imports between AED 187,500 and AED 375,000 can choose to register voluntarily for the UAE VAT system..

- Exempt Businesses: If your business does not meet the above thresholds, VAT registration is not required.

Important VAT Compliance Considerations

1. VAT Filing & Tax Returns

- Businesses should file their VAT returns either monthly or quarterly, based on their specified business classification.

- You should sustain accurate VAT documentation plus provide valid tax invoices to clients.

2. VAT Exempt & Zero-Rated Goods/Services

- Zero-rated items: The UAE considers healthcare, education, and international transport as zero-rated products subject to no VAT taxation.

- VAT-exempt services: Residential property rentals and certain financial services.

3. Penalties for Non-Compliance

The penalty for non-timely VAT registration consists of two types of fines that are AED 10,000 in addition to fines for non-compliance with VAT filings and payments.

- AED 10,000 for late VAT registration.

- Additional penalties for non-compliance in VAT filings and payments.

Read Also: Nol Card Running Low? Recharge in Seconds!

Final Words

Any business operating in the UAE must perform VAT registration because it ensures both tax compliance and operational efficiency. The correct registration process can be initiated through self-registration or tax consultant support or via assistance from free zone authorities and will result in an easy registration experience.

To avoid fines and stay compliant, always:

- Register before crossing the taxable threshold.

- File VAT returns on time.

- Maintain proper VAT records.

Businesses should seek expert VAT advice because it helps them meet all UAE tax regulations while saving time in the process. You can also use our VAT calculator to calculate VAT in seconds.