Want to transfer out of your Bank account? There is no reason to be stressed about closing your Bank account in the UAE. Moving to a new bank, going overseas, or merely no longer needing this bank account are all good reasons to go through the proper closing procedure and not to risk paying a fine or facing a problem with pending transactions.

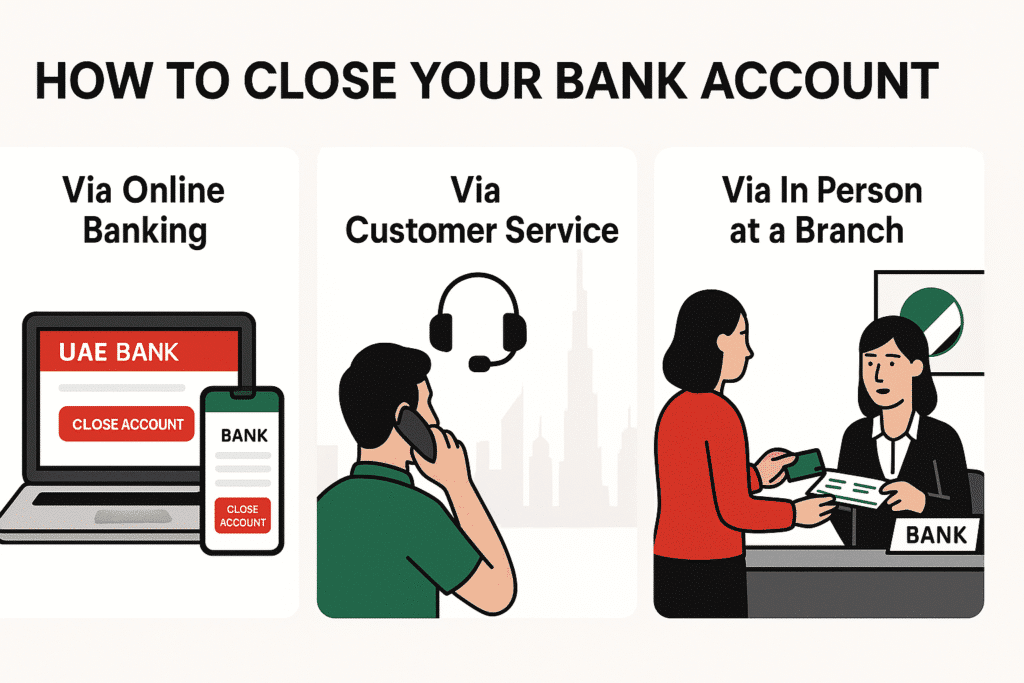

This is the ultimate guide on how you can close your Bank account in 3 simple ways:

- To see a branch offline

- Making a phone outcall

- Making the request using online banking

Method 1: Closing the Account in Person at a Branch

Closing your Bank account in person is the best, fastest, and safest approach you can make, in this case.

Step 1: Clear Any Pending Transactions

Ensuring that your account is clean is something you cannot do without before you intend to even set foot in the branch. This means:

- Wait until any cheques that you have issued are cleared.

- Take away whatever is left over – Money or just shifting it to some other account.

- Cancel standing orders – In case of automatic payments or direct debiting, cancel them to stay out of trouble.

Failure to undertake this step runs the risk of your closure not matching the time of your exit.

Step 2: Prepare Required Documents

There are documents you will have to take along. Without them, the bank won’t do your closure:

- Valid Emirates ID (for UAE residents)

- Passport + visa page (for non-residents)

- Cheque book (if issued)

- Debit card (linked to the account)

- Account closure request form (you’ll fill this out at the branch)

Step 3: Visit the Nearest Bank Branch

When all this is prepared, go to the nearest branch during working hours. When you are here:

- Visit the service desk for the customers

- Inform them that you would like to shut your account

Step 4: Fill Out the Account Closure Form

In the form that will be provided by the representative, he/she will:

- Give your account number

- State your rationale for closure.

Step 5: Settle Any Fees or Dues

Some of them come with closure fees when;

- Within 6 months of having the account open, you are closing it

- You have been short of the minimum on your balance for far too long

Check and ensure that you pay the dues as soon as possible.

Step 6: Receive Closure Confirmation

When all this is done:

- The bank will give you a closure acknowledgment

- Processing time is often between 2-5 working days

- In case you have remaining funds, they would be paid to you or would be moved to a different account

Read Also: F25 Bus Dubai: AED 3 Ride from Metro to Al Quoz (Full Guide)

Method 2: Closing the Account via Phone Banking

In cases where you may be unable to visit a branch physically, you can close through the phone banking of the Bank.

Step 1: Call Customer Service

- Inside UAE: Call 600 522 229

- International: Call the international service @ U.A.E. from outside the U.A.E.

Step 2: Verify Your Identity

The representative will inquire your confirmation:

- Emirates ID number

- Account number

- Security Question answers (e.g. Last amount of transaction)

Step 3: Request Account Closure

- Let them hear in no uncertain terms that you wish to shut your account.

- They can even want a signed closure form to be sent by email or cared.

Step 4: Complete Any Additional Requirements

You can be requested to:

- Fax your ID copies

- Clear existing fees before the closure processing is done

After it has been done, you will be notified through email or SMS.

Method 3: Closing the Account via Online Banking

Through online banking or the mobile app, some of the Bank accounts can be closed.

Step 1: Log in to Online Banking

- Go to the Bank site online, or you can download the mobile app.

Step 2: Navigate to the Account Services Section

- Search the menu for the option called “Close Account” or “Service Requests.”

Step 3: Submit Closure Request

- Log in with your account number

- Authenticate yourself with an OTP on a registered mobile number

Step 4: Wait for Processing

- The bank can call you to seek confirmation on the request

- It may take 5 business days to process

Important Things to Know Before Closing Your Account

In the UAE, it is not that simple to close a bank account by signing a form. I shall put a few points to be considered critically:

- There is a minimum balance you are supposed to have before you close, and there is a fee associated with this

- Credit facilities- At least, you must clear your loan or credit card facility with the bank.

- Standing instructions- Cancel them to prevent bounced payments

- Linked accounts – Any associated accounts with your main account (savings, deposit, or investment account) need to be dealt with separately

- Closure fees – On the official site of the Bank (or by calling customer care), check the latest charges for closing an account

My Pro Tips for a Smooth Closure

This is what I will advise you to do to make it smooth:

- Go to the branch when you can- It is much quicker and probably less prone to error

- Salary credit close behind it -When your employer credits salary to this account, then change the bank details first

- Use past statements as a backup- You will later need them as tax or visa records

- No last-minute scramble- Get started on the process a week or so in advance of when you want it done

FAQs

1. Can I close my Al Hilal Bank account via the Internet?

Some of the account types are indeed available to close via online banking or the mobile application. Log in and go to Account Services, Close Account, and read the instructions.

2. What is the time to close the Al Hilal Bank account?

The application normally takes 2-5 working days since making yours in person and paying all dues.

3. Do you charge to close an Al Hilal Bank account?

The closure is free in case your account exceeds the minimum balance and is more than 6 months old. Otherwise, there can be a small fee.

4. Which documents are required to close my account?

You will require your Emirates ID or passport, cheque book and debit card, and the account closure form.

5. Am I able to deactivate my account outside the UAE?

Yes, you can just call the customer service and do the phone banking stuff. They can request emailing or couriering scanned documents.

Read Also: F41 Bus Timings Today, Route, and Fare Guide [2026]

Final Thoughts

When you understand how to go about it, it is easy to close your Al Hilal Bank account. As to whether to do it in person or via phone, or online, just be sure that you are ready with the right documents and that there are no pending transactions or dues.

Use the approach that best fits your case, and your account will be closed within only a few days without wasting much of your time and without causing any useless delays.