Most people transfer their money between Qatar and India banks. You may want to use an old fashioned approach, and send money to the bank or use a more modernized process via the Internet, either way, you should know what the various methods are and what the process will entail.

In this guide, I will be taking you through the process of transferring money between Qatar bank and Indian bank, the process at hand, charges incurred and how to make sure your money is transferred successfully.

Methods to Transfer Money from Qatar Bank to Indian Bank

You can transfer money in a Qatar bank to an Indian bank in a number of ways. They are usually done in the following ways:

1. Direct Bank Transfer

A bank transfer is a safe measure that will enable transfer of money through your bank account in Qatar to an Indian bank. Here’s how you can do it:

Gather Information

Before you initiate the transfer, you’ll need certain details:

- Beneficiary’s Information:

- Full name of the recipient

- Indian bank account number

- IFSC code (Indian Financial System Code)

- Bank name and branch address

- Your Qatar Bank Information:

- Account number

- Branch Code

- Any other required details

Visit Your Qatar Bank

- Step 1: Go to your Qatar bank in person.

- Step 2: Inform the bank representative that you want to transfer money to India.

- Step 3: Provide all the required details and fill out the necessary forms.

Pay Any Associated Fees

International transfers are normally subjected to fees by banks. The charges are subject to change in accordance with the amount and the policy of the bank.

- Check the Fee Structure: Confirm the transfer charges before initiating the process.

- Exchange Rate: Request the prevailing exchange rate between Qatari Riyal (QAR) and the Indian Rupee (INR) because this will determine the amount of money that will be received by the receiver.

Confirm the Transfer

- Step 1: After the details have been given, ensure that transfer has been initiated.

- Step 2: You should receive a confirmation receipt from your bank.

- Step 3: Save the receipt for tracking and proof of transaction.

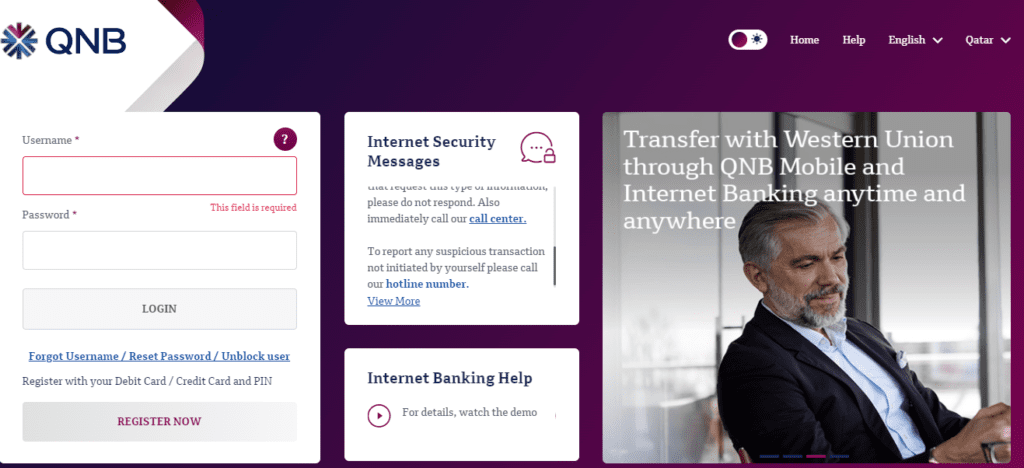

2. Online Banking

Online banking is an easy and fast process of money transfer without necessarily having to visit the bank physically. In the event that your Qatar bank provides online banking, then the following are the steps to take:

Log Into Your Online Banking Account

- Step 1: Visit your web browser and enter your online banking portal with your credentials to Qatar bank online banking portal

Find the Transfer Option

- Step 2: Look for options such as “Transfer Funds” or “Remittance.”

Enter Recipient Details

- Step 3: Input the recipient’s details, including:

- Name

- Indian bank account number

- IFSC code

- Bank name and branch address

Select Currency and Amount

- Step 4: Select the currency which is Indian Rupees (INR) and enter the value which you want to transfer.

Confirm and Submit

- Step 5: Before confirming the transfer, all the details should be reviewed.

- Step 6: Additional security verification (like an OTP or password) may be required for the transaction.

3. Mobile Banking App

Another quick and effective means of sending money to India is by using your mobile banking application by the Qatar bank. Majority of the banks have mobile banking applications which make this process easier.

Download and Install the App

- First step: install your banks mobile app in either App Store or Google Play.

Log In

- Step 2: Use your login credentials to access the app.

Navigate to Transfers

- Step 3: Use the application to locate the transfer funds or remittance button.

Follow the Steps

- Step 4: Fill in the same information as you would have filled in the online banking method:

- Beneficiary’s name and account details

- IFSC code

- Amount and currency (INR)

4. Money Transfer Services

In case you would like to have an alternative non-bank option, or simply compare the costs, Western Union, MoneyGram, or TransferWise (previously called Wise) are all popular money transfer services.

Choose a Service

- Step 1: Choose which service you would like to use. The following are some of the popular services:

- Western Union: It is renowned with fast transfers and extensive network.

- MoneyGram: This is also a common service that has associated competitive charges.

- Wise (formerly TransferWise): Offers transparent fees and favorable exchange rates.

Provide Details

- Step 2: Forward the details of your Qatar bank account and those of the recipient in India bank account.

Pay the Fee

- Step 3: Money transfers are done at a fee in every service. The ready fee is normally computed on the basis of:

- The transfer amount

- The destination (India in this case)

- The urgency of the transfer (instant transfers often cost more)

Receive Tracking Information

- Step 4: You will receive a tracking number or receipt on which you can track the status of the transfer.

Important Considerations for Money Transfers

In terms of sending money in Qatar to India, there are few main things that you should remember:

1. Exchange Rates

The exchange rates may differ significantly between one provider and the other. Always verify the rate at which you transfer because even a minor variation may make a big difference to what your recipient will get.

2. Fees and Charges

- Service Fees: Third-party companies such as Western Union and Wise can offer cheaper fees but can exchange depending on the size of the transferred amount.

- Service Fees: Companies like Western Union and Wise may charge lower fees but can vary depending on the amount being transferred.

3. Transfer Time

The method of reaching the recipient with the money is dependent on how fast it is:

- Bank Transfers: This can take 1-3 business days depending on both banks’ processing times.

- Online and Mobile Banking: These are normally done quicker, within 1-2 days.

- Money Transfer Services: Instant transfers are available but may come with higher fees.

4. Security

Then make sure that you are on safe sites, be it the online portal of your bank, a mobile application or even a trusted money transfer service. Check the recipient details to ensure that there is no mistake.

5. Legal Limits

The money transfer between Qatar and India may have some limitations. These limits may be different depending on the financial regulation of Qatar and India, so be aware of them.

- Note: Always stay within the legal limits and report any large transactions if required.

6. Tracking and Confirmation

Never forget to keep your receipts and confirmation numbers. These may be employed to monitor the transfer and give evidence in case there are some problems.

7. Customer Support

When it comes to your transfer, you should always have the contact information of your customer support with your bank or transfer service. Easy to approach them in case of delays or problems.

Read Also: Dubai Islamic Bank SWIFT Code: Fast & Easy Guide

Conclusion

To move money in Qatar bank to an Indian bank, it is possible to use a variety of ways, such as direct bank transfers, online and mobile banking, third party services such as Western Union and Wise. Both ways have the advantages, and they rely on your requirements, charges, and time to get your money.

Convenience, speed, or cost are all things that matter; however, by taking these measures, you will be able to transfer money safely and efficiently.