Workmen’s compensation insurance or also termed as employers’ liability insurance, is a very important type of cover required in Dubai and the United Arab Emirates (UAE). This insurance is aimed at securing both the employer and the employees against any economic consequences that might arise out of work-related accidents or ailments. Here we will explore the meaning, importance, and advantages of Workmen’s Compensation Insurance to both employees and employers, and also give a list of the top 10 workmen’s compensation insurance providers in Dubai.

What is Workmen’s Compensation Insurance?

Workmen’s compensation cover is a cover to ensure work accidents or sickness benefits employees through compensation or medical care. It guarantees employees receive medical treatment and their wages during the recovery period. This insurance also protects the employers against possible lawsuits as a result of accidents in the workplace.

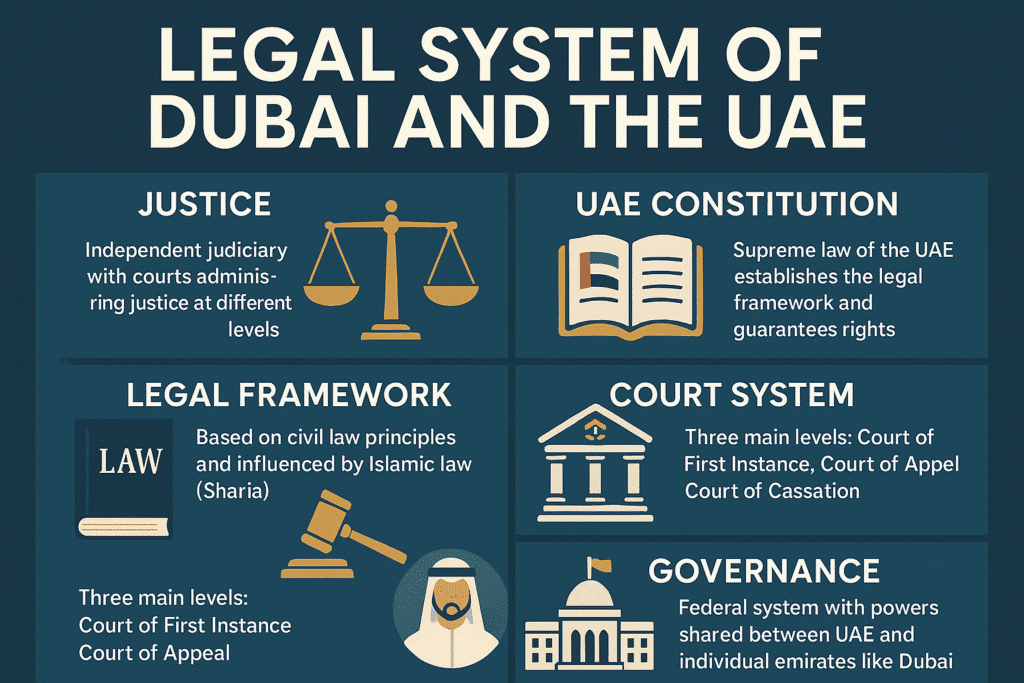

Legal Framework in Dubai and the UAE

In the UAE (Dubai included), the workmen criminal insurance insurance is a statutory requirement as stated in the UAE Labor Law. Such a legal requirement is in place to guarantee that all businesses take reasonable measures to protect their employees, leading to the creation of a safer working environment, and the associated financial impact is reduced on both employees and employers in case of any accident.

Benefits of Workmen’s Compensation Insurance

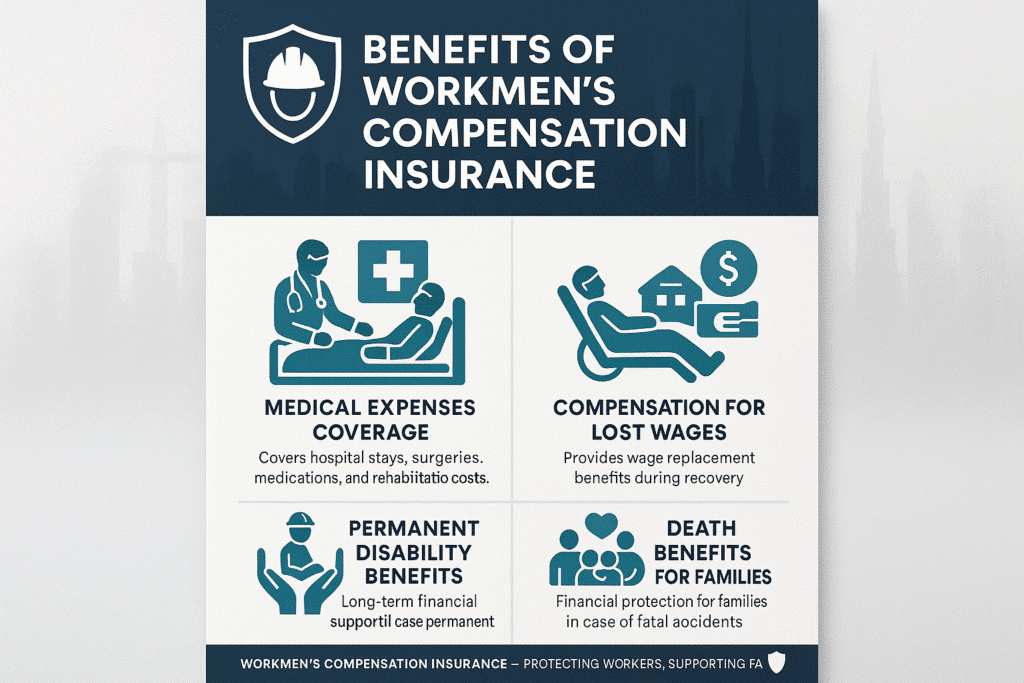

Medical Expenses Coverage

Among the major advantages of the workmen compensation insurance is the cover possible expenses on medical treatments as a result of injury or illnesses occasioned in work. This entails the expenses incurred in hospitalization, surgery, drugs, and rehabilitation. By absorbing such costs, the insurance makes employees concentrate on their recovery without having to worry about the financial ramifications.

Compensation for Lost Wages

During the recovery period, employees may be unable to work and thus lose their regular income. Workmen’s compensation insurance provides wage replacement benefits to cover a portion of the lost wages. This helps employees maintain their financial stability while they recuperate.

Permanent Disability Benefits

Where the employee gets a severe injury leading to permanent disability, workers’ comp provides disability benefits. All these benefits are aimed at supporting the injured ex-employee in the long run, on how to cope with the new lifestyle.

Death Benefits for Families

Some work-related accidents are tragic in the sense that they cause fatalities. In that event, the family of the employee who has died gets workmen’s comp insurance as a death benefit. The compensation usually covers a lump-sum compensation as well as life-long financial assistance to enable the family to overcome the loss.

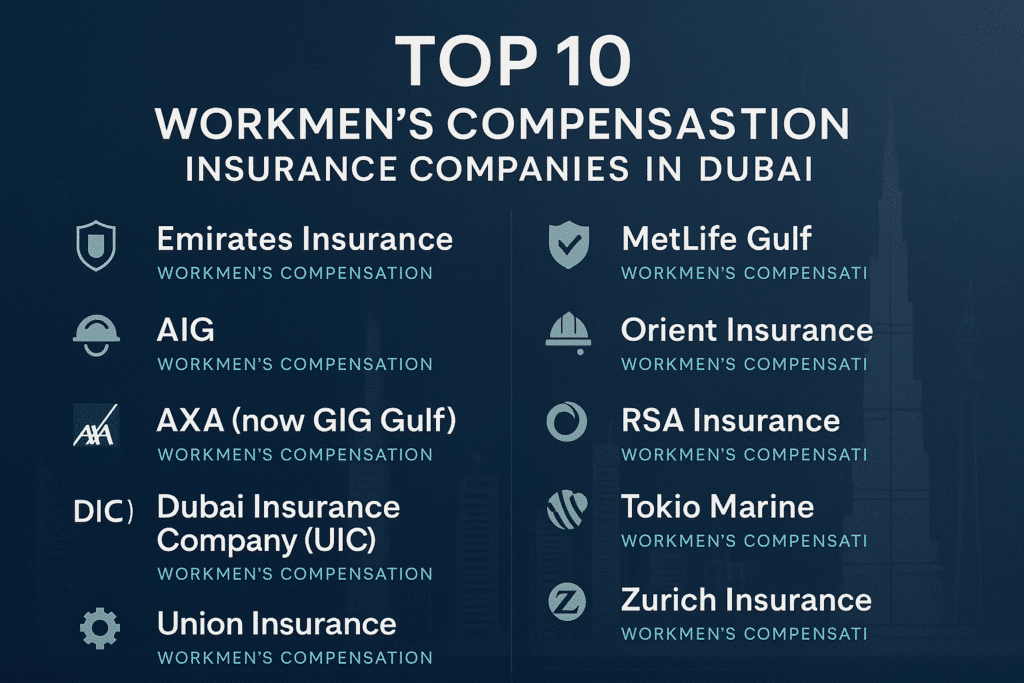

Top 10 Workmen’s Compensation Insurance Companies in Dubai

1. Emirates Insurance

Emirates Insurance and Majid Insurance it one of the oldest Insurance companies in the UAE that sell an extensive range of workmen’s compensation insurance. Their plans are aimed at including medical cover and reimbursement of lost income and paid disability benefits, and covering workers generously.

2. AIG

AIG It is a multinational insurance company that is well represented in Dubai. They offer diverse insurance services that include workmen’s compensation insurance. The experience and worldwide coverage of AIG give it a good reputation as an insurance coverage service provider.

3. AXA (Now GIG Gulf)

AXA, GIG Gulf, previously known as GIG which is an international and reputable insurance firm, specializes in providing the workmen’s compensation coverage to firms within the region. They have a set of policies that address the needs of different industries to protect the workers and the employers fully.

4. Dubai Insurance Company (DIC)

Dubai Insurance CompanyIt is a large hometown insurance company that offers workmen’s compensation schemes to companies of all magnitudes. DIC policies are highly flexible and tailored to the local laws, hence popular among businesses in the UAE.

5. Union Insurance Company (UIC)

Union Insurance Company is one of the top insurance companies in the UAE with workmen’s insurance policies that assure conformity with the laws of the land. UIC offers tailor-made coverage options, such as increased employer liability coverage to suit the requirements of businesses.

6. MetLife Gulf

MetLife Gulf, A well-established provider of life and health insurance, also covers workmen’s compensation as one of the business coverages. Their policies help to provide maximum coverage to employees so that both the worker and employer are at peace.

7. Orient Insurance

Orient Insurance is a leading regional insurance company that deals with workmen’s compensation insurance for businesses in the UAE region. They offer very comprehensive coverage in terms of medical bills, lost income, and disability insurance in the form of their policies.

8. RSA Insurance

RSA Insurance is a global insurance company that provides workmen’s insurance coverage in a local partnership in Dubai. Their policies are tailored to the individual needs of companies, offering very broad cover and the benefit of peace of mind.

9. Tokio Marine

Tokio Marine The company is one of the biggest global insurance providers dealing with workmen’s compensation insurance to businesses in Dubai. They develop special policies to suit the particular needs of industries and provide a comprehensive coverage of workplace injuries and illnesses.

10. Zurich Insurance

Zurich Insurance It is a worldwide insurer dealing with workmen’s compensation insurance in Dubai. Their policies offer extensive coverage to both employees and employers that guarantee adherence to the local laws concerning labor and financial security.

Read Also: How to Check Fines in Abu Dhabi: Step-by-Step Instructions

FAQs

Q1. What is work injury insurance?

Work injury insurance (workers’ compensation) gives free coverage for medical costs and lost wages after a workplace accident.

Q2. How do I claim free work injury insurance?

Report the injury, visit a doctor, and file a workers’ compensation claim.

Q3. Who is eligible for workplace injury insurance?

Most employees are covered by free work injury insurance; contractors may need separate coverage.

Q4. What does work injury insurance cover?

It covers hospital bills, rehabilitation, partial wages, and disability benefits.

Final Words

Dubai and the UAE require the workmen’s compensation insurance to be an essential part of any business in operation. It yields invaluable advantages to both the workers and the employer, guaranteeing that medical expenses and missed wages are compensated to workers and employers, avoiding huge financial losses and legal matters. With a better insurance provider and conformity to the local laws, businesses can help provide a safer and secure work environment to all involved individuals.